Insights >

How ecommerce has affected the Japanese luxury market

New: Japanese Consumer Behaviour – 2025 report | download for FREE >>

The luxury market in Japan is undoubtedly massive. It is the third largest luxury goods market globally1, after the U.S. and China, and to put it into perspective, almost a quarter of all LVMH’s physical stores across the Asia region are located in Japan. Although the market has experienced some turbulence, especially after the 2011 Tohoku earthquake and more recently the pandemic, for the most part, it has experienced steady growth throughout the past decade.

But as the luxury market continues to grow in Japan, one major factor has caused a shift in the industry– ecommerce. And although the ecommerce industry has been expanding as a whole in Japan, the luxury market looks a bit different. This article explores how ecommerce fits into the luxury market in Japan, the effects of the pandemic, as well as future trends.

As stated previously, the luxury industry has had strong market growth for a number of years and continues to grow year on year. Currently, Japan spends around 3 trillion yen every year on designer brands, which include everything from jewellery and makeup to handbags and apparel.

However, although the adoption of digital channels such as websites and social media have become almost necessary, the market has been slower to pick up ecommerce and other digital trends. In fact, Japan only has an ecommerce penetration rate of 8.7%2, much lower than in many other countries.

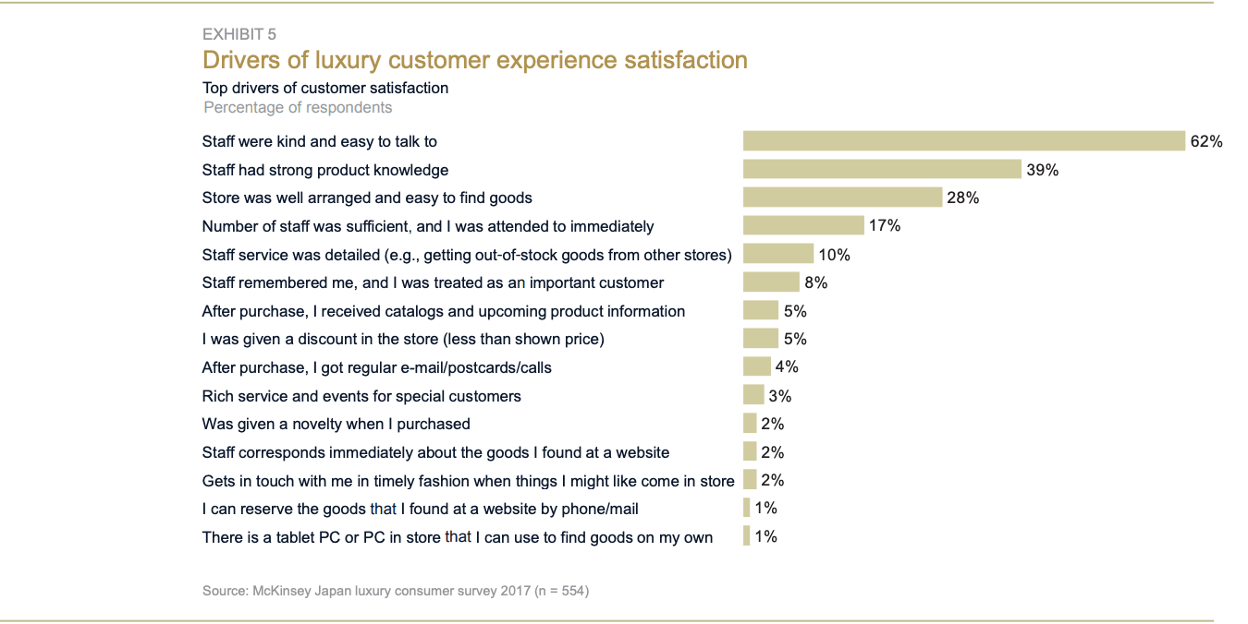

This may be due to the fact that a big part of the luxury shopping experience is about customer service and the environment of a store visit. A 2017 McKinsey report states that point of sale remains crucial. This concerns both information gathering and purchasing, and is connected to the fact that customers expect ‘sales excellence’. Japanese shoppers expect that the salesperson will be easy to talk to, have strong product knowledge, and provide a personalised experience.

Japan’s rapidly ageing population may also be part of the reason why the ecommerce industry has had such sluggish growth. One specific area of ecommerce, mobile ecommerce, has had a particularly slow adoption rate. A 2019 report by Morgan Stanley states that mobile ecommerce accounts for under 25% of ecommerce sales in Japan. This may be attributed to the ageing population, who are more reluctant than younger generations to make online purchases on smartphones.

Another major reason for the lack of luxury goods online is that major ecommerce marketplaces like Rakuten and Amazon have yet to include luxury goods on their platforms. And the ones that do sell luxury goods, such as Moda Operandi, still have low awareness in Japan. Meanwhile, China’s Alibaba-owned Tmall sells products from brands such as Chanel and Bottega Veneta.

COVID-19 largely halted all in-store sales for a number of months, forcing brands to either shorten their opening hours or temporarily close. Globally, the luxury goods market decreased by 25% in the first quarter of 20203. This forced many retailers to reconsider their sales strategy.

However, according to a study by Euromonitor, there was only a limited shift to e-commerce during the pandemic for luxury goods in Japan. Instead, digital platforms were utilised as a way to engage with customers rather than actually sell luxury products.

Nevertheless, given that Japanese consumers value quality and are very loyal to brands, some industry leaders believe that the market will recover well in the post-pandemic days.

Although luxury brands’ adoption of ecommerce is relatively low, there’s no doubt that the pandemic has profoundly accelerated the country’s digital shift. For example, Shopify’s sales figures from their 2020 Black Friday-Cyber Monday sales event saw the highest growth for the Japanese market at 350%.

Japan’s growing ecommerce market has left a huge opening for luxury brands to enter into. Since experiential shopping is so critical for the luxury market, brands can consider omnichannel marketing such as online-to-offline (O2O). This entails driving online customers to come into physical stores to make their purchases in-person. O2O strategies include things like click-and-collect, LINE promotions, QR codes, or using tablets in stores so customers can view the entire inventory.

As both industry and marketing trends shift, knowing the right way to enter the market is absolutely critical. The bilingual account managers at DMFA are happy to support you in any of your online marketing needs.

We are also happy to announce a new partnership with PayPay Mall, one of Japan’s top ecommerce marketplaces. We are the only overseas partner who can get your goods into this exclusive platform. Through our three-way agreement with a Japanese ecommerce agency, we can help you with the fulfilment, logistics, and customer service so that you can get your foot in the door of selling your goods in Japan. Contact us to learn more about this solution.