Insights >

2026 Guide to Digital Advertising in Japan | Q&A

New: 2026 Japanese Marketing Calendar | download for FREE >>

Japan, a technologically advanced nation, presents a lucrative market for digital advertising. The country has a traditional business culture but also has a large online population. Recently, there has been a shift towards digital shopping, making digital advertising essential for growth in Japan.

In this blog article, we will answer the most frequently asked questions about digital advertising in Japan. Read on to discover how to understand the enormous market potential for businesses. This is important for those looking to grow and connect with customers online.

Frequently Asked Questions

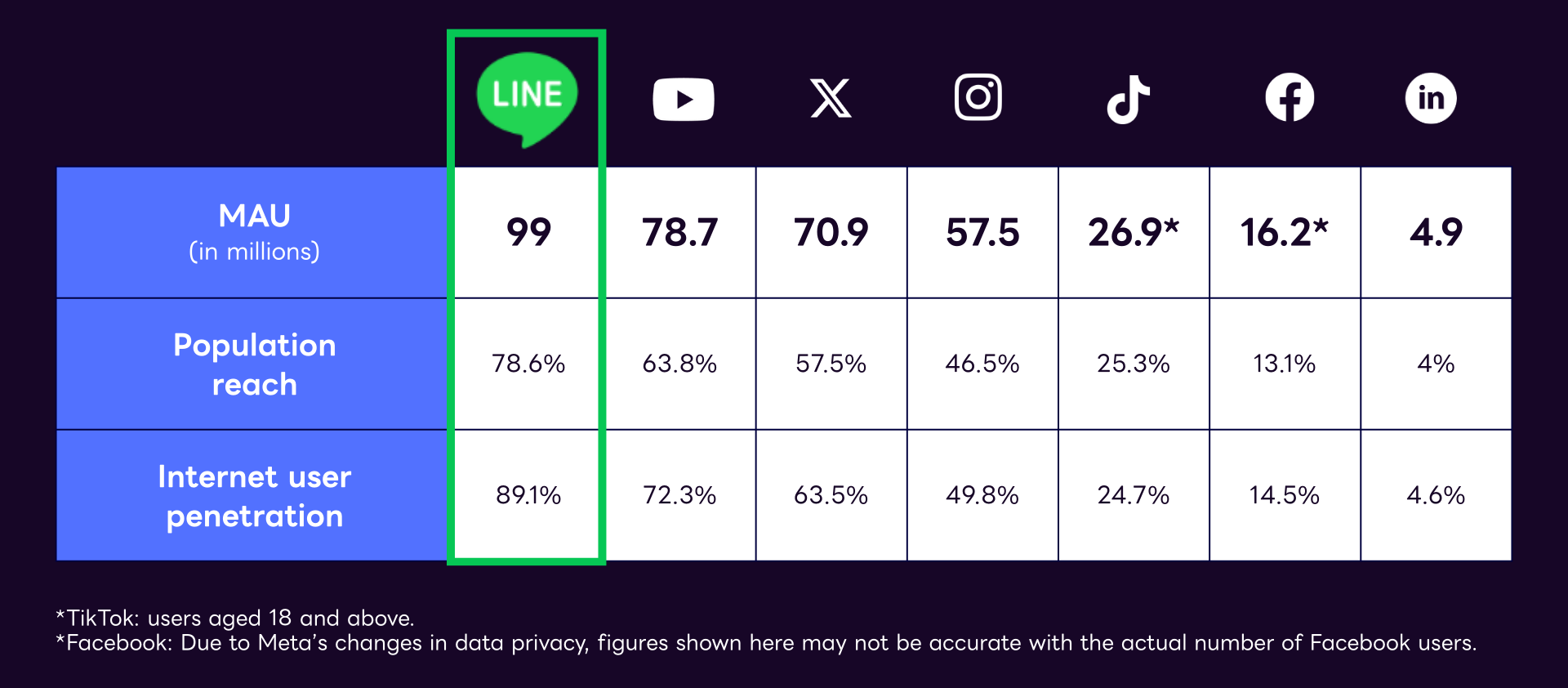

LINE is Japan’s most widely used social media platform, followed by YouTube, Twitter and Instagram.

You can read our blog to understand why LINE is Japan’s most popular social media platform here →

Yes. LINE is an excellent platform to reach Japanese users. We provide our clients with free support for LINE Ads.

You can download our free LINE Ads Media Guide to learn more about the platform here →

Google is Japan’s most popular search engine, holding 80.2% of the market share. Yahoo! JAPAN is second, at 10.18% search engine market share.

Yahoo! JAPAN is much more than just a search engine. It’s a network of connected services that Japanese users interact with at multiple touchpoints throughout the day.

Read our blog to learn what Yahoo! JAPAN is here →

Yahoo! JAPAN is a comprehensive portal offering search, news, shopping, and more. It’s a fantastic platform for reaching a broad Japanese audience.

Read our blog to discover the full range of Yahoo! JAPAN advertising formats and placements here →

To run brand awareness campaigns across Japan’s major portals, focus on Yahoo! JAPAN and LINE, which together reach 94% of active smartphone users. Use display ads on Yahoo! News and portal sites for older desktop audiences, and combine with LINE’s premium placements for mobile-first users. Leverage portal-specific formats like Yahoo! JAPAN Brand Panel and LINE Talk Head View for maximum visibility.

Japan’s digital landscape centers around two dominant platforms: Yahoo! JAPAN and LINE. Yahoo! JAPAN is the country’s largest internet portal, holding 10.18% search engine market share but powering a much larger ecosystem including Yahoo! News (62+ million monthly visitors), Yahoo! Mail, Yahoo! Auction, and Yahoo! Shopping. LINE, with 99 million monthly active users (77% population penetration), functions as a super-app integrating messaging, social feeds, news, shopping, and payments.

Beyond these two giants, Google dominates search at 80.2% market share, but its advertising reach concentrates on high-intent queries rather than passive portal browsing. For brand awareness specifically—where you’re building recognition rather than targeting active searchers—Yahoo! JAPAN and LINE are the essential channels.

Why portals matter for awareness: Portal users browse passively through news, entertainment, and information content, making them ideal for building brand recognition. Unlike search engines, where users have specific intent, portal audiences are in discovery mode. This creates multiple impression opportunities that build brand familiarity over time.

Japan’s portal audiences segment by age and device, requiring adjusted strategies:

Remember to localize your content. English proficiency is relatively low in Japan. This means that all marketing materials, including ad copy and landing pages, must be in Japanese. Otherwise, they will simply get lost in the highly competitive marketplace.

The Japanese language is complex and full of cultural nuances. It is essential to work with native Japanese speakers, who can check your marketing materials before publishing.

Aligning your marketing with the local calendar is another essential strategy. Each year, we publish a free Japanese Marketing Calendar to help you tick off the most critical dates →

Yes. English proficiency in Japan is only 25%; English-only campaigns reach minimal audience. All ad copy, landing pages, and customer communication must be in Japanese. It is critical to work with native Japanese speakers who understand cultural nuances and can proofread for tone/formality. Most effective: hire Japanese copywriter to create original Japanese content, not translated English copy. Poor Japanese quality signals amateur brand; invest in professional localization.

Japanese internet users respond to specific creative approaches:

Staying on top of the latest trends is an important thing for marketers. Read our blog on advertising in Japan in 2026 to discover the latest trends and predictions here →

Initial data collection: 2-4 weeks. Awareness lift becomes measurable after 3-4 weeks. Optimal campaign duration: 8-12 weeks for seasonal campaigns, ongoing 12+ months for evergreen products. Brand search lift typically appears 1-2 weeks post-campaign start. Continuous campaigns outperform short bursts. Japanese consumers need 7-12 impressions for brand recall. Plan multi-month campaigns for meaningful ROI.

Using the same ad creative on both Yahoo! JAPAN and LINE is not recommended. While some core messaging carries over, platforms require format adjustments. Yahoo! JAPAN News favours information-dense, text-heavy ads (50+ words). LINE favours visual, minimal-text designs. Yahoo! JAPAN Brand Panel ads work as static display. LINE Talk Head View requires high-impact, thumb-stopping visuals. Different audiences: Yahoo! skews older (45+), LINE skews younger (25-45). Invest in platform-specific creative; A/B test messaging to identify what resonates with each audience.

Japan has a strong e-commerce market due to factors like high internet penetration (84.9% as of 2024), a culture of convenience, and a wide range of online payment options.

Partnering with a trusted local agency can benefit both small and large brands. Japanese experts can help you understand the complexities of the market, proofread your ad copy, and offer optimisation suggestions.

We are part of the LINE Yahoo global sales team and support our clients free of charge. Learn more about how we work with individual brands and partner with marketing agencies to support their client base.

Effective video ads for Japanese audiences should be mobile-optimized (vertical or square format), culturally nuanced with subtle messaging, and distributed across LINE, Yahoo! JAPAN, and YouTube. Focus on storytelling over direct selling, use soft colour palettes, incorporate seasonal themes, and keep videos concise (15-30 seconds for ads, longer for content). Japanese consumers prefer emotional narratives and high production quality, making investment in production critical for success.

Japanese video preferences differ fundamentally from Western approaches:

Japanese consumers strongly prefer long-form landing pages with comprehensive product information, averaging twice the content length of Western pages. These information-dense pages typically include multiple CTAs (call-to-action) distributed throughout the page, scrolling CTAs, and detailed product specifications to address Japan’s risk-averse consumer culture.

Unlike Western preferences for minimalist design, Japanese users expect text-rich communication that provides complete product details upfront. Long-form landing pages align with Japanese cultural preferences for thorough information before purchase decisions.

Loyalty programs significantly boost ad performance in Japan, with 48% of consumers actively participating in major programs like Rakuten Points and T-Point, driving repeat purchases and increased engagement. Point accumulation campaigns and seasonal promotions dramatically increase spending during peak shopping periods, while bonus point offers generate strong response rates that exceed Western markets.

The Japanese loyalty market reached $3.87 billion in 2025, growing at 15.4% annually, demonstrating massive consumer adoption. Japanese consumers exhibit exceptional responsiveness to point-based incentives, with most programs offering 1 point per ¥100 spent (approximately 1% return).

Integrating CRM data with Japan-focused campaigns requires connecting popular local platforms like LINE Messaging API, Yahoo! JAPAN Ads, and Japanese payment systems to your CRM infrastructure through native integrations or third-party connectors. Major global CRMs including Salesforce, HubSpot, and Zoho offer LINE integration capabilities that enable automated chatbots, targeted segmentation, and personalized messaging based on purchase history and behavior data. Successful CRM integration strategies for Japan emphasize LINE as the primary communication channel rather than traditional email, with LINE Official Account Messaging API allowing businesses to synchronize customer data for real-time personalized communication, achieving message open rates exceeding 60% compared to 4-5% email open rates.

Managing translations for dynamic ad content in Japan requires implementing professional Japanese localization workflows that go beyond literal translation to capture cultural nuances and business communication styles. Use translation management systems that support UTF-8 character encoding and can handle the complexity of Japanese scripts including hiragana, katakana, and kanji characters across dynamic ad templates. Major advertising platforms like Meta and LinkedIn offer multilingual ad capabilities that automatically display Japanese versions to targeted audiences.

Dynamic content translation must account for text expansion, as Japanese can be 20-30% shorter than English, affecting ad layouts and character limits. Work with native Japanese copywriters who understand advertising conventions rather than relying solely on machine translation.

Optimize Japanese landing pages for mobile-first users by implementing responsive design with comprehensive information architecture that maintains text-rich content while ensuring fast load times under 3 seconds. Japanese mobile users expect information-dense layouts with multiple conversion points, scrolling CTAs, and prominent phone numbers for instant contact, contrasting with Western minimalist mobile design. Mobile optimization must prioritize proper Japanese character rendering with UTF-8 encoding and mobile-friendly font sizes that accommodate kanji readability.

Google’s mobile-friendly algorithm prioritizes responsive landing pages, making mobile optimization essential for both user experience and SEO performance in Japan. Japanese consumers access the internet primarily via smartphones, with mobile penetration exceeding 80% and users checking devices 10-15 times daily.

Download our free trend report on Mobile App Marketing in Japan here →

Prioritize APAC market expansion by evaluating factors including market size, regulatory complexity, cultural barriers, sales cycle length, and localization resource requirements against your company’s capabilities and timeline. Japan offers stability and high-value contracts ideal for B2B companies with long-term commitment and localization resources, while markets like Singapore and South Korea provide faster entry, English-friendly environments, and quicker sales cycles for companies needing early traction. Strategic expansion typically begins with markets requiring minimal localization before tackling complex markets like Japan that demand 24-month entry periods. Companies in fintech, AI, cybersecurity, or SaaS targeting enterprise clients benefit from prioritizing Japan first due to higher contract values and strong regulatory frameworks.

Structure UTM tagging for Japan and APAC reporting by implementing consistent naming conventions that include geographic identifiers (Japan, APAC), language codes (ja, en), and market-specific campaign parameters using standardized formats. Use Google’s Campaign URL Builder to generate properly formatted UTM parameters that track utm_source (LINE, Yahoo_Japan, Google_Japan), utm_medium (cpc, display, social), utm_campaign (product_launch_japan_2025), and utm_content for A/B test variants. Establish custom channel groupings in Google Analytics 4 that separate Japan performance from broader APAC metrics for accurate regional analysis.

Japan campaigns commonly underperform due to insufficient budgets to compete in Japan’s highly competitive digital advertising market, poor website conversion rates post-click, and failure to localize products and messaging for Japanese cultural expectations. Budget constraints prevent adequate testing and scale against well-funded Japanese competitors who invest heavily in marketing, while Western-style websites fail to convert Japanese traffic that expects information-dense, trust-building content.

Website conversion issues frequently stem from inadequate localization rather than campaign targeting or ad creative problems. Japanese consumers expect comprehensive product information, customer reviews, local payment options (LINE Pay, PayPay, konbini), and Japanese-language customer support. Fix underperforming campaigns by investing in proper localization (24-month timeframe for major markets), building credibility through customer success stories, and focusing on early adopter engagement before aggressive scaling.

Competitive analysis for Japan’s digital landscape requires using tools like Semrush, Ahrefs, and Similar Web to analyze competitors’ keyword rankings, backlink profiles, and traffic sources across Japanese search engines including Google Japan (74.91% share), Yahoo! JAPAN (9.18% share), and Bing Japan (14.55% share). Monitor competitors’ presence on Japan-specific platforms like LINE Ads, Yahoo! Japan Ads, and Rakuten Advertising in addition to global platforms like Google and Meta to capture complete competitive intelligence.

Use Semrush’s Market Explorer and Traffic Analytics tools to provide market share data, audience demographics, and traffic benchmarks essential for understanding competitive positioning in Japan. Social media competitive analysis must track Japanese platforms including LINE (99 million users), Twitter/X (highly active in Japan), Instagram, and YouTube rather than focusing solely on Western-dominated platforms like Facebook.

Major Japanese portals like Yahoo! JAPAN feature core content categories including News, Shopping, Auctions, Weather, Finance, Sports, Entertainment, and Q&A communities that drive massive daily engagement. Yahoo! JAPAN Shopping organizes categories by Women’s Fashion, Men’s Fashion, Electronics, Food & Beverages, Beauty & Cosmetics, Home & Kitchen, Sports & Outdoors, and Automotive, reflecting Japanese consumer shopping priorities. The portal format provides immediate access to diverse services rather than minimalist search-focused interfaces, aligning with Japanese preferences for information-rich environments.

News content performs exceptionally well on Japanese portals, with Yahoo! JAPAN News serving as a primary news source that aggregates content and drives significant traffic within the Yahoo! ecosystem. Successful content strategies for Japanese portals emphasize comprehensive information delivery, seasonal relevance, and integration with e-commerce functionality.

Typical conversion events for Japan-focused campaigns include Add to Cart, Purchase, Form Submission, Phone Call (click-to-call), LINE Friend Addition, Email Signup, Demo Request, Download, and Appointment Booking, with measurement approaches adapted to Japan’s mobile-first and messaging-app-centric behaviors. Purchase and Add to Cart events are critical for e-commerce campaigns, with platforms like LinkedIn and Meta allowing multiple conversion events per user within conversion windows to accurately track repeat purchase behavior common in Japanese loyalty program environments.

Lead generation campaigns emphasize phone call conversions and LINE Official Account friend additions as primary events, reflecting Japanese preference for direct communication over form fills. Japan-specific conversion tracking requires longer conversion windows (30-90 days) to accommodate thorough decision-making processes, particularly for B2B purchases where multiple stakeholders participate in consensus-driven buying.

We are official overseas media reps for LINE Yahoo! advertising products. We provide clients with 100% free support, a dedicated account manager, and the latest market insights.

Click here to contact our team and discuss how we can support your brand in Japan.