Insights >

What is SNS? Social Media in Japan

New: 2026 Japanese Marketing Calendar | download for FREE >>

Japanese social networking services (SNS) represent one of the world’s most sophisticated and unique digital ecosystems, offering unprecedented opportunities for marketers who understand its nuances. With 109 million active social media users representing 88.3% of Japan’s population, the Japanese market demands a strategic approach fundamentally different from Western markets.

This comprehensive analysis provides enterprise-level insights into Japan’s SNS landscape, equipping marketing professionals with data-driven strategies for 2025 and beyond.

Table of Contents

SNS (Social Networking Service) is the preferred terminology in Japan for what Western markets call “social media”. This linguistic distinction reflects deeper cultural differences in how Japanese consumers conceptualize and utilize these platforms.

While the terms are functionally equivalent, “SNS” encompasses the full spectrum of digital networking tools – from traditional social networks like Instagram and Facebook to messaging-centric super-apps like LINE, video platforms like YouTube, and microblogging services like X.

The term SNS is ubiquitous in both Japanese marketing discourse and everyday conversation, describing platforms used for:

🤝 Relationship formation and maintenance: Building connections with individuals, brands, and communities;

🤝 Information exchange: Consuming and sharing news, entertainment, and educational content;

🤝 Commercial engagement: Discovering products, researching purchases, and completing transactions;

🤝 Revenue generation: Supporting advertising-based business models that dominate the ecosystem.

This comprehensive definition underscores why understanding SNS requires more than platform familiarity – it demands insight into the cultural values, communication preferences, and behavioral patterns that shape Japanese digital engagement.

Read our blog on the 2025 social media landscape in Japan here →

Japan’s SNS ecosystem is characterized by exceptional 97.5% mobile penetration, platform diversity, and culturally distinct engagement patterns.

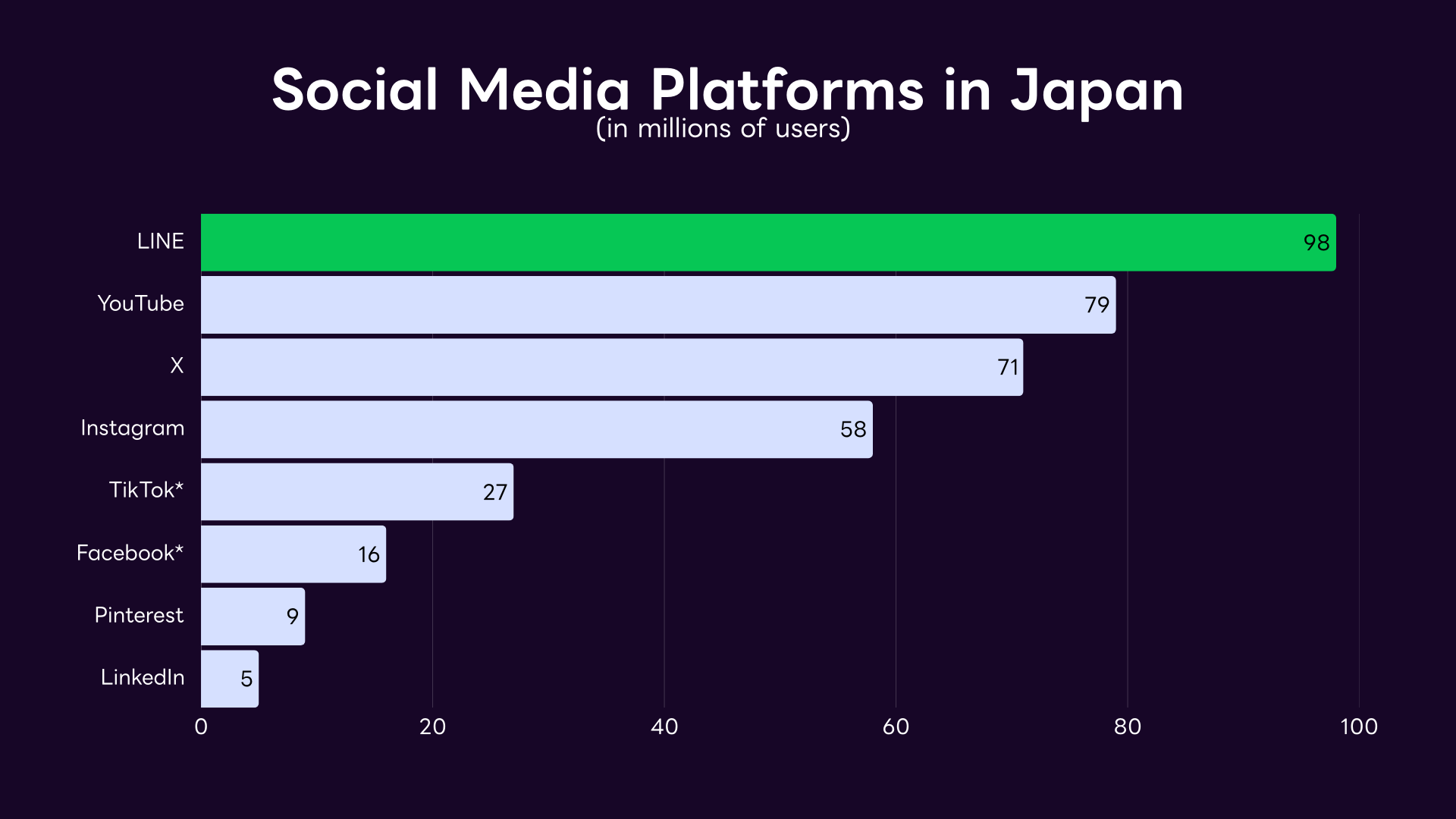

LINE maintains its position as the dominant super-app with 98 million monthly active users, followed by YouTube and X (Twitter). The social commerce market has reached USD 25.33 billion with projected annual growth of 9.9%, while influencer marketing expenditures have surged to ¥86 billion (USD 570 million).

Unlike Western markets, where Facebook dominates, Japan’s unique digital behaviour emphasises privacy-first platforms, utility integration, and content authenticity over polished corporate messaging.

As of March 2025, Japan had 109 million Internet users, which makes up 88.2% of the total population, according to the most recent report by DataReportal.

Here is a breakdown of the most popular social media platforms in Japan.

LINE transcends its messaging app origins to function as Japan’s essential digital infrastructure. With 98 million monthly active users covering 78.7% of the population, LINE achieves near-ubiquitous adoption across all demographic segments.

The platform’s user base demonstrates remarkable demographic balance: 53.3% female and 46.7% male, with age distribution spanning from teenagers to those over 60.

Read our blog on why LINE is the most popular platform in Japan here →

YouTube maintains exceptional penetration with 78.7 million users representing 63.4% of Japan’s population. The platform achieves the highest average time spent among video services at 21.4 hours per month per user, with demographics showing balanced gender distribution (48.4% female, 51.6% male).

X maintains robust engagement with 70.9 million active users (57.5% population penetration), making Japan the platform’s second-largest market globally after the United States. The platform demonstrates remarkable resilience despite global challenges, with Japanese users tweeting 3.8 times more frequently than the global average.

Instagram has achieved 60.1 million users (48.2% population penetration) as of 2025, with particularly strong appeal among younger demographics and women. The platform’s user base skews 57.6% female and 42.4% male, with the 25-34 age group comprising the largest segment at 14.7 million users.

TikTok has achieved 26.9 million users in Japan, representing 18% year-over-year growth. The platform ranks as the most downloaded mobile app and second in time spent (20 hours 55 minutes per month on Android), demonstrating exceptional engagement among younger demographics.

Facebook maintains approximately 16.2 million users in Japan, representing significant decline from its 2015 peak. The platform’s user base skews older, with 55.6% female and 44.4% male users, and the 25-34 age group representing the largest segment.

LINE is the most popular messaging app in Japan. Its integration with various aspects of daily life has solidified its position as a dominant force. With 98+ million monthly active users, LINE is an excellent platform to add to your digital mix for Japan.

With one of the country’s best ad placements, LINE Ads offers highly effective opportunities for advertisers.

Want to learn more?

Download our free LINE Ads Media Guide to learn more →

LINE’s success can be attributed to several factors:

With only 16 million monthly active users, Facebook is not a dominant platform in the country. Several factors contribute to Facebook’s lower popularity in Japan:

Twitter’s popularity in Japan stems from:

Successfully navigating the Japanese digital landscape requires a sophisticated understanding of SNS and its role in consumer behaviour.

Here are key strategies for maximizing your marketing efforts:

Japanese culture values respect and politeness. Ensure your brand messaging aligns with these values. Japanese society is highly group-oriented.

Consider how your brand can integrate into existing social circles and communities.

Tailor your content to resonate with Japanese tastes, preferences, and humour. This includes language, imagery, and storytelling.

Foster a strong sense of community and interaction through regular and meaningful engagement. Provide exceptional customer service on social media platforms, especially on LINE.

Collaborate with Japanese influencers who align with your brand values to reach a wider audience.

Given Japan’s high smartphone penetration, ensure your website and content are fully optimized for mobile devices. Consider developing a dedicated app, especially if your business model aligns with the super app concept popularized by LINE.

Integrate popular mobile payment options like LINE Pay to enhance user experience. LINE Pay will integrate into PayPay from 30th April 2025.

Utilize platform-specific analytics to gain deep insights into audience behaviour. Experiment with different content formats, messaging, and visuals to optimize performance.

Regularly review and refine your SNS strategy based on data-driven insights.

Stay vigilant for potential crises or negative sentiment on social media. Develop a crisis management plan to address issues promptly and effectively. Be honest and transparent in your communication during a crisis.

By implementing these strategies and understanding the Japanese market deeply, you can effectively leverage SNS to build a strong brand presence and drive business growth.

DMFA is the official representative for Yahoo! JAPAN and LINE. We provide our clients with free support on advertising services.

DMFA is the official representative for Yahoo! JAPAN and LINE. We provide our clients with free support on advertising services.

Fill in the form and our team will get back to you as soon as possible →