Insights >

Social Media in Japan 2025 – everything you need to know

New: 2026 Japanese Marketing Calendar | download for FREE >>

What are the most popular social media in Japan in 2025?

Japan’s social media landscape in 2025 presents a unique ecosystem where traditional global platforms compete alongside distinctly Japanese solutions. This creates unprecedented opportunities for brands that understand the cultural nuances driving consumer behaviour.

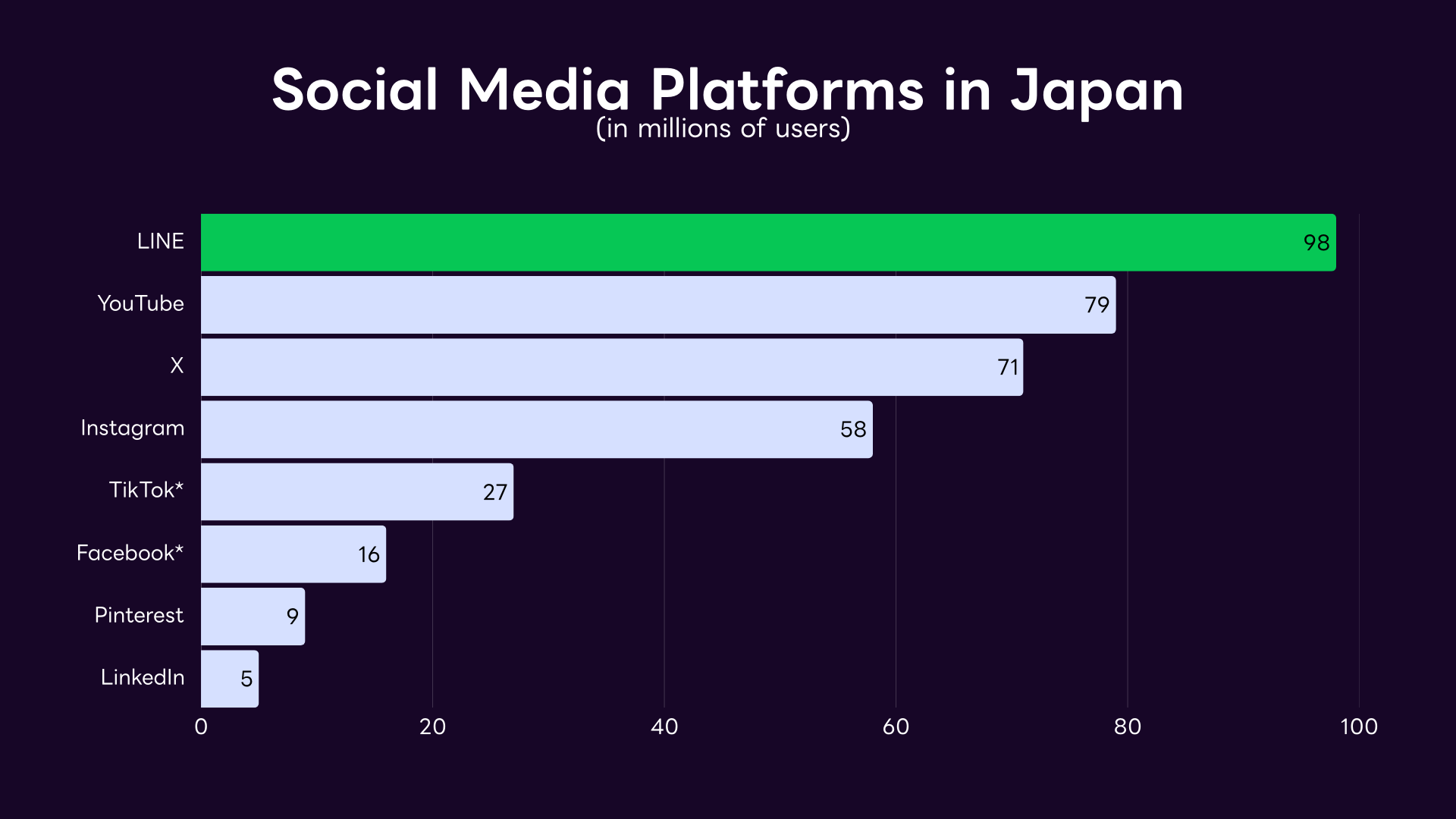

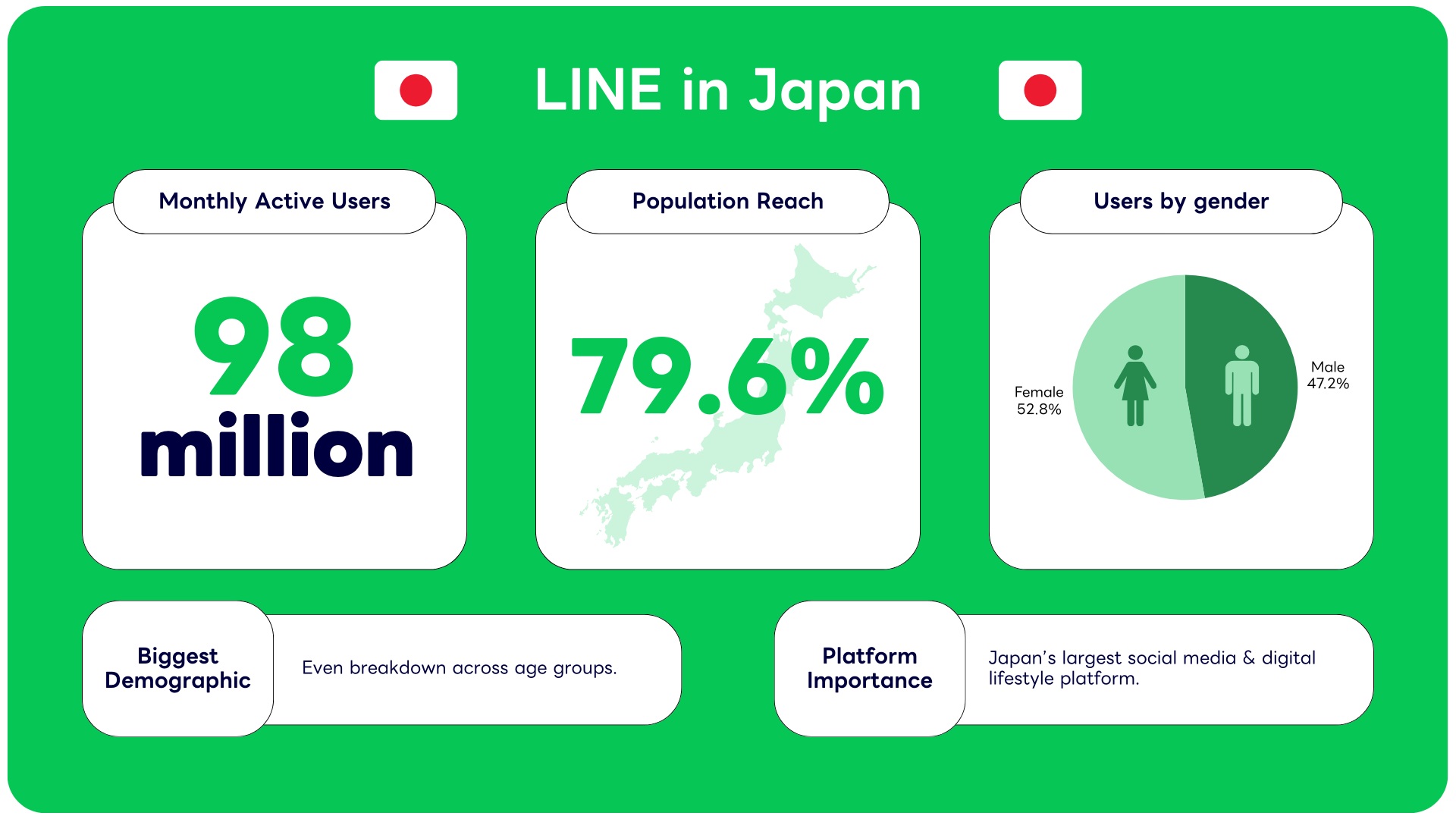

LINE continues its dominance with 98 million monthly active users, representing 79.6% of the population.

Emerging platforms like TikTok achieve remarkable growth rates, particularly among Gen Z demographics.

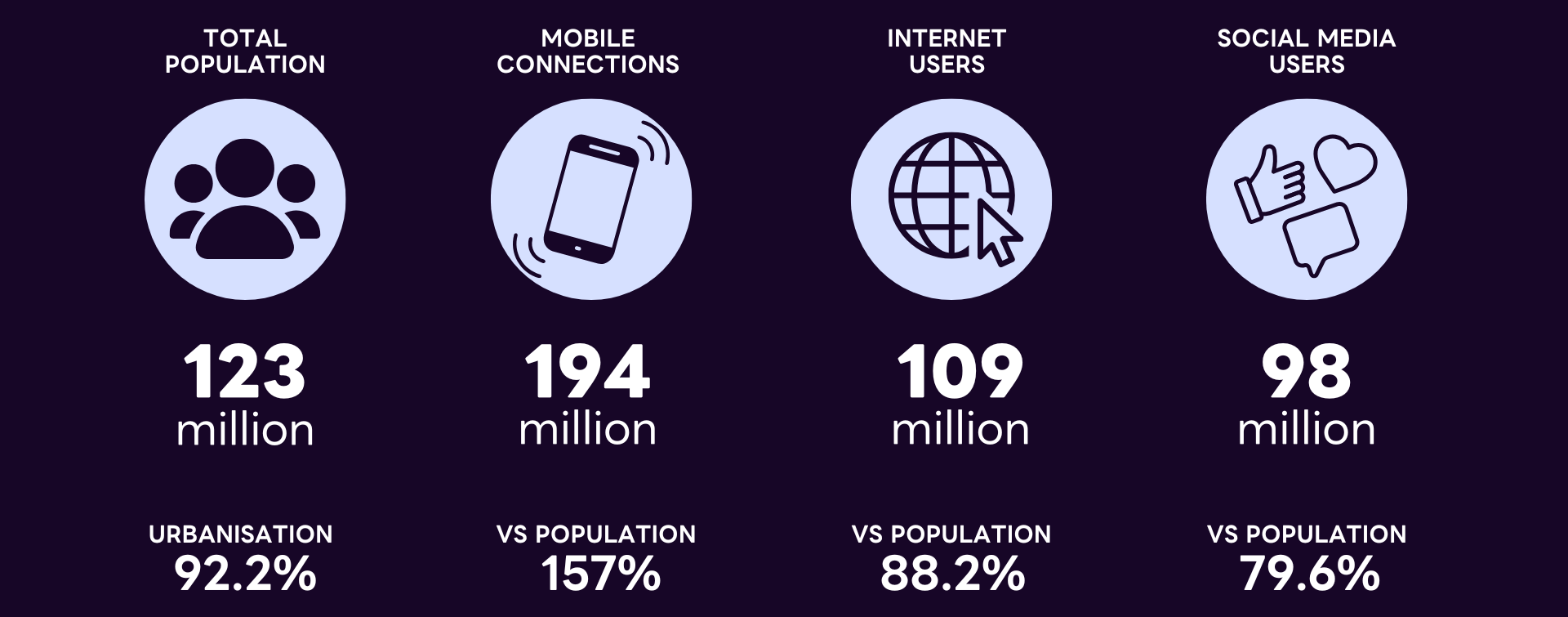

This comprehensive analysis reveals that 88.3% of Japan’s 123.4 million population actively engages with social platforms. This totals approximately 109 million users across multiple channels. Unlike Western markets, Japanese consumers demonstrate distinct preferences for privacy-first engagement and utility-integrated platforms.

Table of Contents

The strategic implications for international brands are important. Success means going beyond simple translation. Brands need to use complete localization strategies.

They should leverage Japan’s unique multi-platform ecosystem, where messaging apps act as super platforms. Video content helps with discovery, and authenticity is more effective than polished corporate messaging.

📊 Internet penetration reaches 88.2% with 109 million active users across social platforms.

📊 Mobile-first consumption dominates with 97% mobile penetration.

📊 Privacy preferences influence platform selection, with anonymous interaction capabilities driving adoption.

📊 Commute-driven engagement patterns create 70+ minute daily usage windows on public transport.

📊 Cultural integration determines platform success, with localized features outperforming global standard offerings.

⭐️ LINE maintains market leadership with 98 million MAU (79.6% population reach).

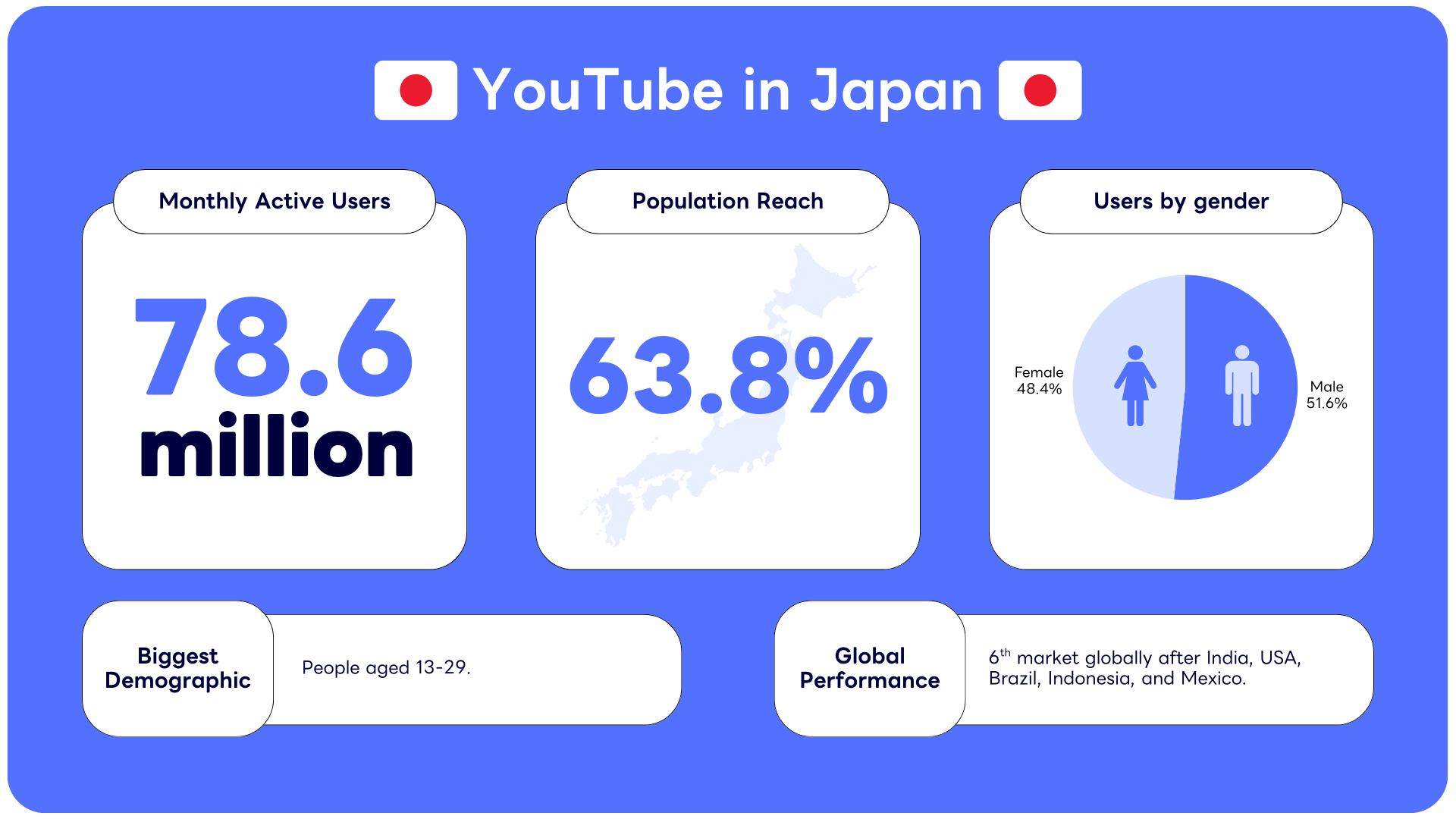

⭐️ YouTube reaches 78.7 million users (63.8% of the population) as the main video platform.

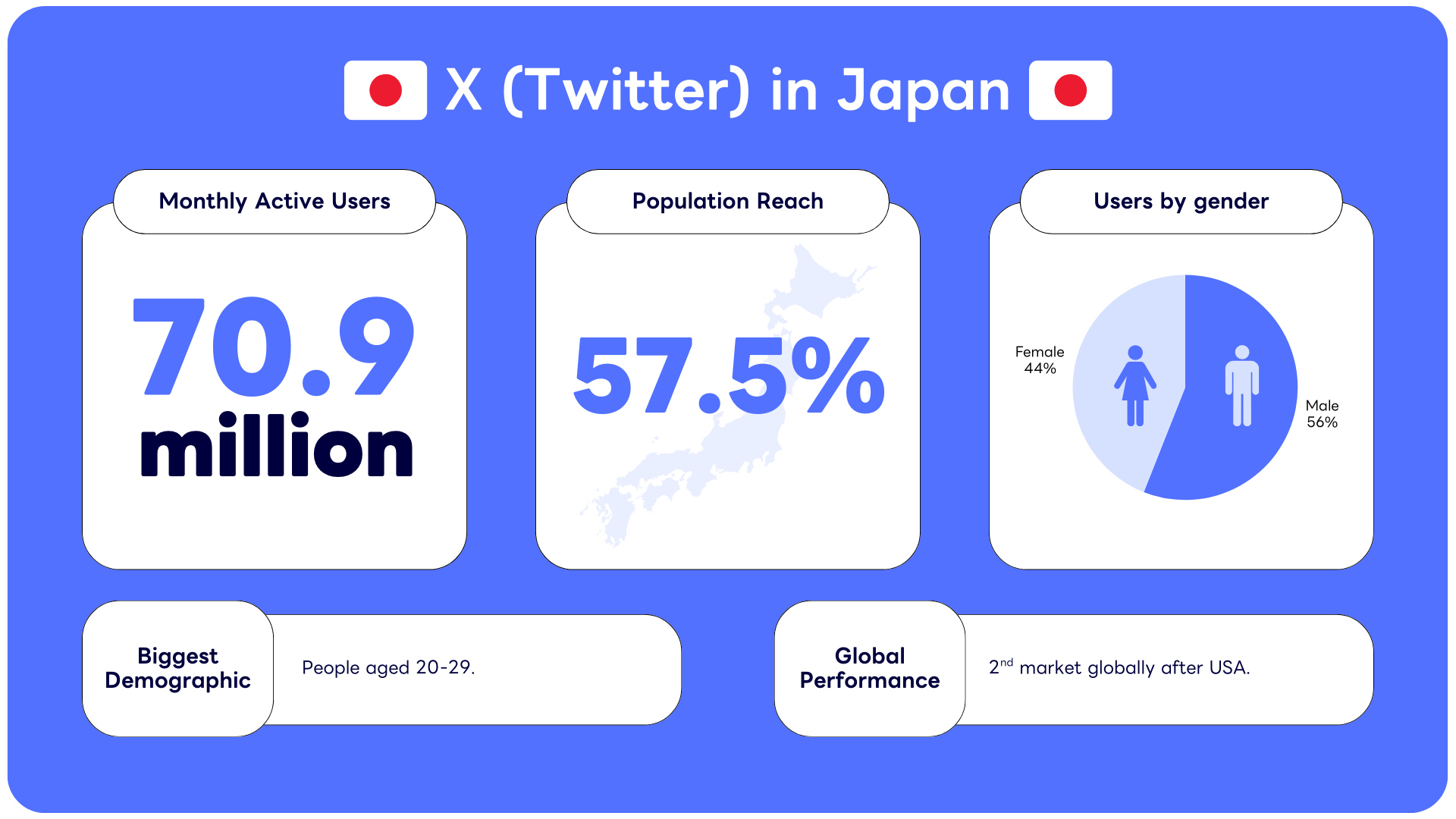

⭐️ X (Twitter) sustains 70.9 million users (57.5% population) as primary news and discussion platform.

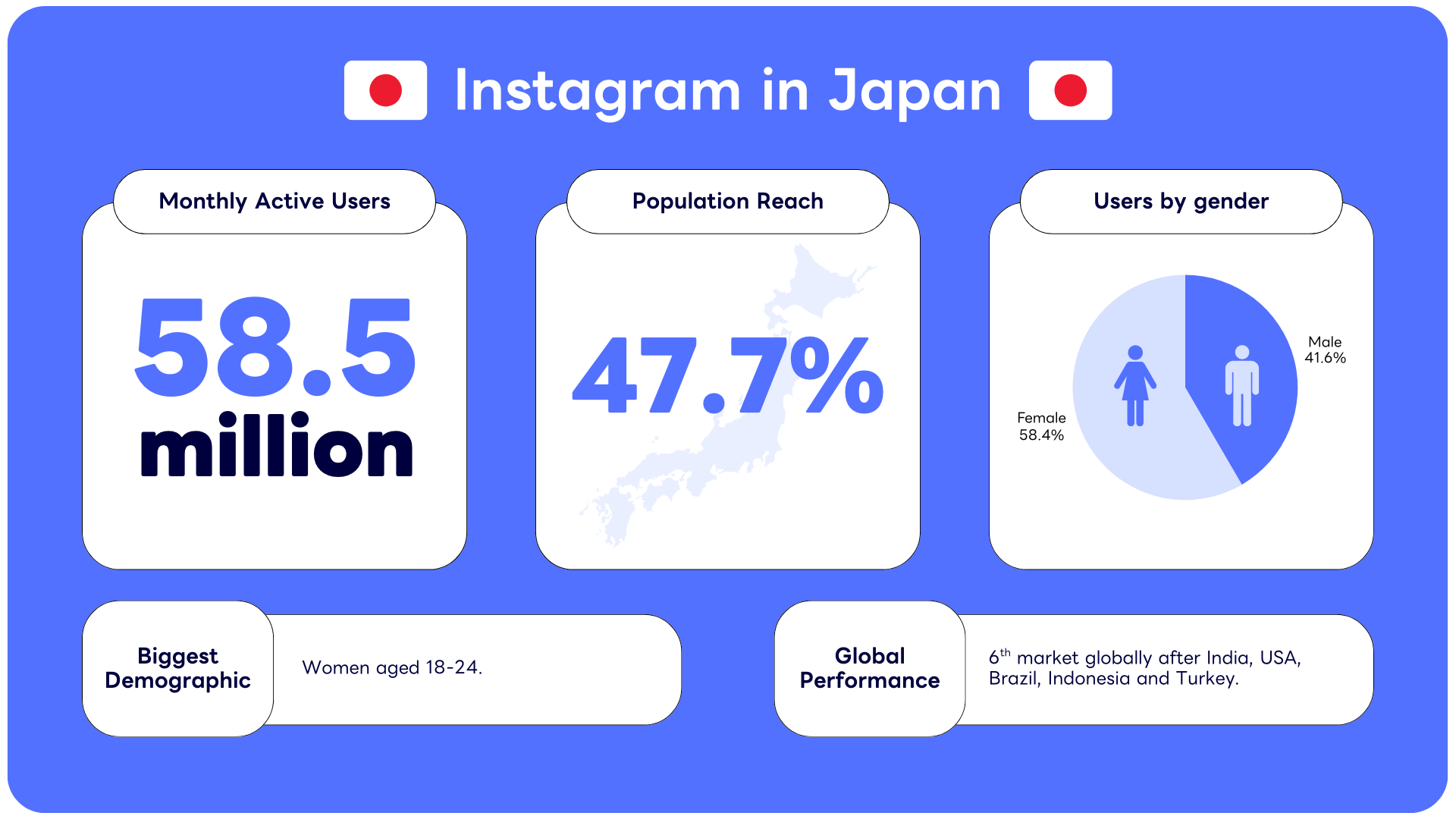

⭐️ Instagram reaches 58.5 million users (47.7% population) with 57.6% female demographic skew.

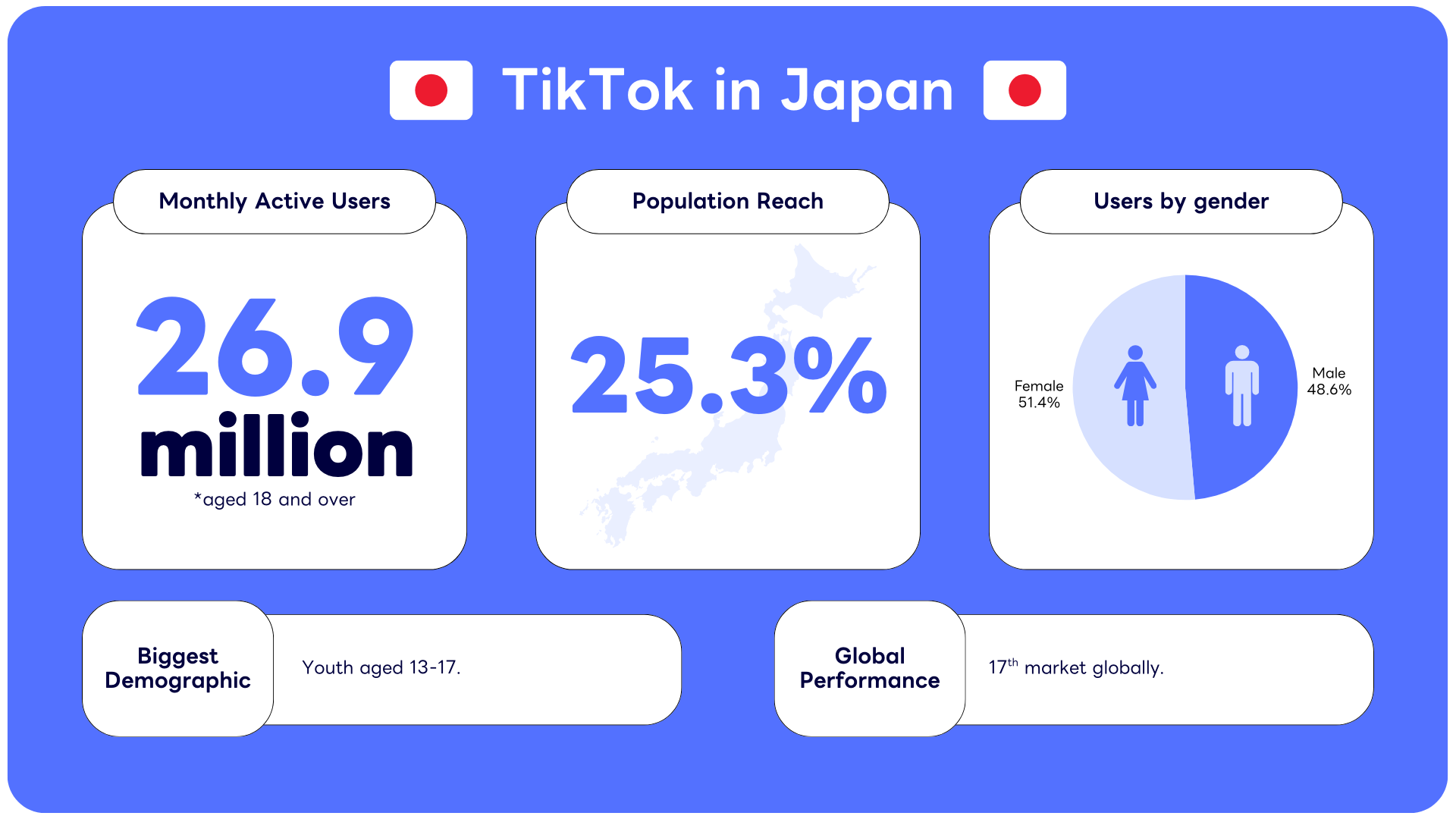

⭐️ TikTok demonstrates explosive growth with 26.9 million users aged 18+ (15% YoY growth).

💡 Influencer marketing projected to reach ¥48.7 billion by 2027 across YouTube alone.

💡 Social commerce integration accelerating with TikTok Shop launching June 2025.

💡 LINE Official Accounts provide direct customer access for 3+ million business accounts.

💡 The cross-platform advertising market is expected to grow at a 14.8% CAGR through 2026.

Japan’s digital infrastructure provides the foundation for one of the world’s most sophisticated social media ecosystems. With 88.2% internet penetration affecting 109 million users, the market demonstrates both high connectivity and unique behavioral characteristics that distinguish it from Western digital environments.

The nation’s 97% ethnic Japanese demographic composition creates a distinctive monocultural digital environment where content, features, and platform design can be precisely tailored to specific cultural preferences. This homogeneity enables platforms like LINE to develop deeply integrated services that feel native to Japanese daily routines rather than foreign adaptations.

Urban concentration drives platform usage patterns, with over 92% of the population residing in urban areas and spending an average of 70+ minutes daily on public transportation. This creates consistent, predictable engagement windows where social media consumption peaks during morning and evening commute periods, fundamentally shaping content strategy and advertising timing for successful campaigns.

Japanese social media behavior reflects deep cultural values that influence platform selection, engagement patterns, and content preferences.

💡 The concept of meiwaku – avoiding causing discomfort to others – significantly impacts online interaction styles, leading to a preference for platforms that enable anonymous participation and private communication over public broadcasting.

💡 Trust and reliability serve as primary platform differentiators in a culture where reputation and social harmony carry significant weight. Platforms that demonstrate consistent reliability, privacy protection, and cultural sensitivity achieve higher adoption rates and user loyalty compared to services perceived as foreign or potentially disruptive to social order.

💡 Quality expectations exceed global standards across content production, user interface design, and customer service interactions. Japanese users demonstrate willingness to pay premium prices for superior experiences, creating opportunities for brands that invest in high-quality localized approaches rather than cost-optimized global standard implementations.

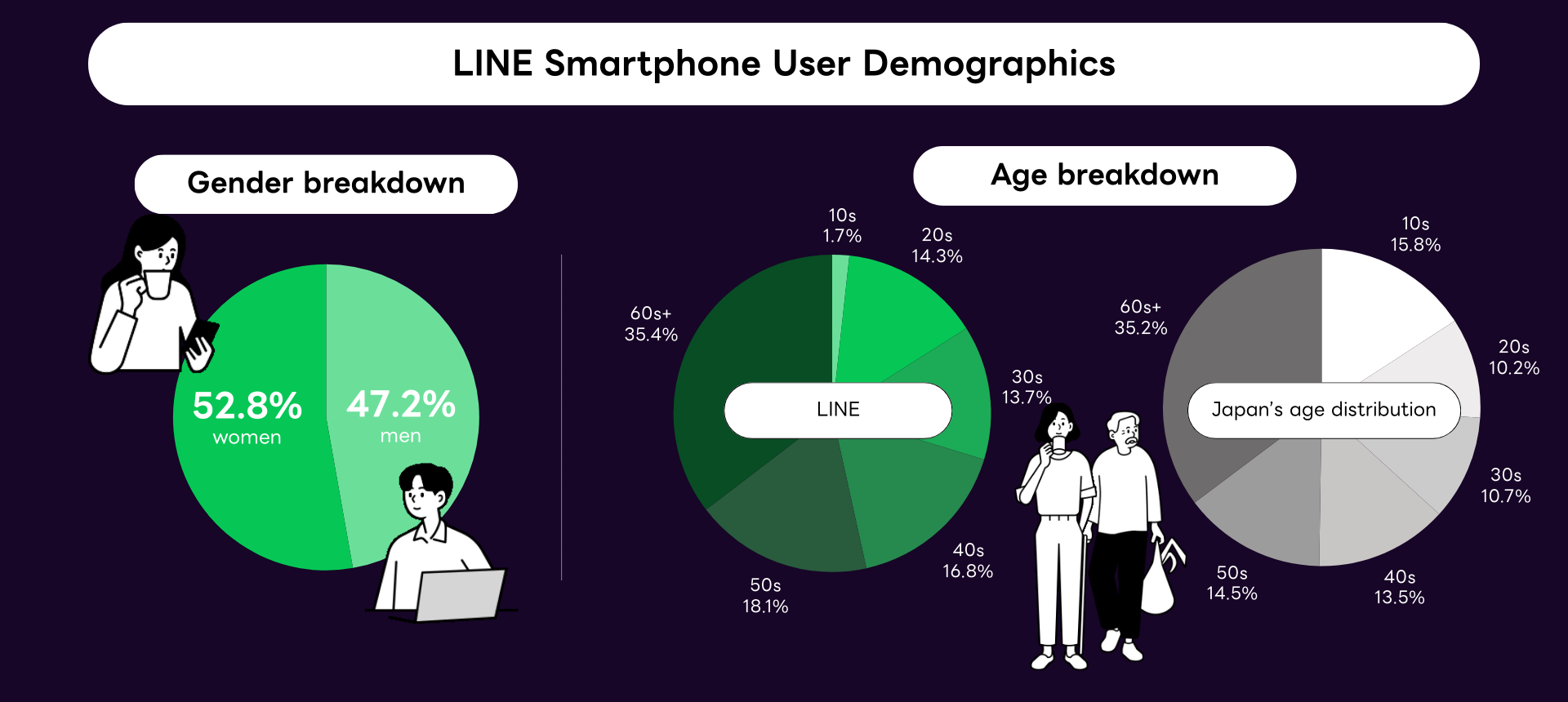

Japan’s aging population creates unique social media dynamics where older demographics possess the highest disposable incomes while younger segments drive platform innovation and trend adoption. This demographic structure requires sophisticated multi-generational marketing approaches that respect age-based platform preferences while maintaining brand consistency.

Professional networking maintains traditional offline emphasis, limiting LinkedIn’s penetration compared to Western markets where professional social media serves as primary career development tool. This cultural preference creates opportunities for platforms that integrate professional functionality within existing social contexts rather than requiring separate professional identity management.

Consumer behavior demonstrates preference for integrated utility platforms over single-function social networks. The success of LINE as a “super app” providing messaging, payments, shopping, news, and entertainment within a unified experience reflects broader consumer expectations for comprehensive digital solutions rather than fragmented platform ecosystems.

LINE maintains its position as Japan’s essential digital infrastructure, with 98 million monthly active users representing 79.6% of the total population. The platform’s evolution from emergency communication tool following the 2011 earthquake to comprehensive super app demonstrates successful localization and cultural integration strategies that international platforms struggle to replicate.

For detailed insights on LINE’s market dominance, refer to our comprehensive analysis: Why LINE is the Most Popular Social Media App in Japan

Demographic Distribution and Usage Patterns

LINE’s user base mirrors Japanese population demographics, with 52.8% female and 47.2% male users distributed relatively evenly across age groups. It is the most age-inclusive platform in Japan’s social media landscape. This demographic breadth provides brands with unparalleled access to complete household decision-making units rather than age-segmented audiences.

Business Integration Opportunities

Over 3 million business accounts utilize LINE Official Accounts for customer service, marketing communication, and sales support. The platform’s integration of messaging, payments, shopping, and customer service creates seamless business-to-consumer interaction opportunities that exceed traditional social media advertising capabilities.

Learn everything you need to know about LINE Official Accounts and how to open one in our blog here →

Advertising on LINE in Japan

LINE Ads has cemented itself as one of the most effective digital advertising tools in Japan, enabled by LINE’s pervasive reach across demographics and daily activities. With over 98 million Japanese users LINE delivers unparalleled audience access and advanced targeting capabilities.

Brands can choose from diverse, high-impact formats including image, video, carousel, and animated ads, served throughout the LINE ecosystem: from the main chat interface, to news feeds, shopping, and entertainment mini-apps. LINE’s robust targeting options let marketers segment audiences by age, location, interests, and behaviors, while enhanced integrations with Yahoo! JAPAN further increase reach and frequency.

As trust and localization are paramount in Japan, advertising within LINE’s familiar environment drives both brand awareness and measurable conversions. Businesses – both global and local – consistently report higher engagement and improved ROI when combining LINE Official Accounts with targeted LINE Ads campaigns.

Download our LINE Ads Media Guide & start advertising on LINE today →

Strategic Implications for 2025

Predicted platform developments include enhanced AI-driven customer service capabilities and expanded business integration tools. The platform’s role as a customer service channel will intensify, with brands leveraging chatbot technology and automated response systems to provide 24/7 support that meets Japanese quality and response time expectations.

LINE in Japan – Key Takeaways for Brands:

💡 Inclusive demographic reach enables household-level marketing strategies.

💡 Super app functionality supports complete customer journey management.

💡 Cultural integration provides trust and reliability advantages over international competitors.

💡 Business account features enable direct customer relationship management.

Professional Recommendations

For Japan market entry and growth, leverage the full potential of LINE Ads to achieve measurable business outcomes. Build multi-format, native advertising campaigns through LINE Ads to maximize reach and relevance across core audience segments. Use LINE’s advanced targeting – demographic, behavioral, and interest-based – to optimize campaign efficiency and minimize waste.

Integrate creative assets that reflect Japanese cultural cues, seasonal themes, and preferred content styles. Combine paid promotion with organic strategies, such as custom sticker packs and interactive messaging, to enhance brand affinity. Consider retargeting and lookalike audiences to sustain engagement and improve conversion rates. Collaborate with local experts for campaign setup, creative adaptation, and real-time optimization, ensuring compliance and resonance in Japan’s unique digital ecosystem.

YouTube in Japan achieves 78.7 million users representing 63.8% of Japan’s total population, serving as the primary platform for video content consumption, educational resources, and trend discovery. The platform’s role extends beyond entertainment to serve as a substitute for traditional television in many households, particularly among demographics aged 18-49.

Content Consumption Patterns and Preferences

Japanese YouTube usage demonstrates distinct content preferences including:

🎬 Educational and tutorial content outperfors pure entertainment.

🎬 High production value expectations exceed global platform standards.

🎬 Mukbang and food content drives significant engagement and cultural trends.

🎬 Gaming content and “Let’s Play” videos maintain consistent popularity.

🎬 ASMR and relaxation content reflect cultural stress management needs.

Download our free white paper about social media in Japan here →

Influencer Marketing Ecosystem

YouTube influencer marketing is projected to reach ¥48.7 billion by 2027, driven by consistent user growth and recognition of content creator influence on purchase decisions. 42% of men aged 15-24 identify YouTube appearances as the primary reason for trusting influencers, highlighting the platform’s role in credibility building.

Advertising Performance and Opportunities

YouTube’s advertising platform provides sophisticated targeting capabilities and measurement tools that enable precise audience selection and campaign optimization. Video ads positioned at sales funnel entry points demonstrate superior performance for retargeting campaigns, particularly when featuring domestic talent and culturally relevant environments.

Strategic Implications for 2025

Content localization requirements exceed simple translation, requiring cultural adaptation, domestic talent integration, and production values that meet Japanese quality expectations. Successful campaigns incorporate seasonal themes, cultural events, and local environmental contexts that resonate with Japanese audiences’ sophisticated content consumption patterns.

Download our free Japanese Marketing Calendar here →

Key Takeaways for Brands

💡 Educational content outperforms promotional material in engagement and conversion metrics.

💡 High production values are table stakes for audience acceptance and brand credibility.

💡 Local creator partnerships provide authenticity and cultural credibility advantages.

💡 Seasonal and cultural integration significantly improves campaign performance.

Professional Recommendations

Collaborate with established Japanese creators to develop authentic content that naturally integrates products or services within educational or entertaining contexts. Prioritize high-quality video production that reflects Japanese aesthetic preferences while incorporating trending content themes like behind-the-scenes footage, product tutorials, and cultural lifestyle integration.

X maintains 70.9 million users representing 57.5% of Japan’s total population, establishing itself as Japan’s second-largest global market after the United States. The platform serves as the primary source for real-time news, political discussion, and trend identification, with unique cultural adaptations that differentiate it from global X usage patterns.

Cultural Role and User Behavior

45% of Japanese social media users prefer anonymous online interaction, making X’s pseudonymous engagement model particularly appealing for expressing opinions and participating in discussions that might be difficult in face-to-face contexts. The platform serves as a vital outlet for political commentary and social criticism in a culture that traditionally values harmony and consensus.

News and Information Distribution

X functions as Japan’s primary digital news distribution platform, with government officials, politicians, and thought leaders maintaining active presence for policy communication and public engagement. Real-time disaster information and emergency communications utilize the platform’s immediate distribution capabilities, reinforcing its role as essential infrastructure rather than optional social media.

Business and Brand Engagement Opportunities

The platform’s real-time nature enables brands to participate in trending conversations, provide customer service, and monitor brand sentiment with immediate feedback capabilities. Japanese users appreciate direct, transparent brand communication that addresses concerns and provides helpful information rather than promotional messaging.

Strategic Implications for 2025

Social listening capabilities provide valuable market intelligence for brands seeking to understand consumer sentiment, emerging trends, and competitive landscape dynamics. The platform’s role in cultural trend identification makes it essential for staying current with rapidly evolving consumer preferences and market conditions.

Key Takeaways for Brands:

💡 Real-time engagement opportunities enable immediate response to trends and issues,

💡 Anonymous interaction preferences require respectful, non-intrusive communication approaches.

💡 News and information focus provides credibility advantages for informative brand content.

💡 Social listening capabilities deliver competitive intelligence and trend identification.

Professional Recommendations:

Develop social listening strategies that monitor brand mentions, competitor activities, and emerging trend discussions. Engage authentically in relevant conversations while providing helpful information and customer support rather than promotional messaging that interrupts organic discussions.

Instagram reaches 58.5 million users representing 47.7% of Japan’s population, with 57.6% female demographic skew and particular strength among users aged 18-34. The platform serves as Japan’s primary visual content discovery engine, driving trends in fashion, beauty, food, and lifestyle categories.

Content Categories and Performance Drivers

Visual storytelling capabilities align with Japan’s rich aesthetic culture, enabling brands to showcase products and services within culturally relevant contexts. Popular content categories include:

📱 Fashion and beauty content drives significant engagement among female demographics.

📱 Food photography and restaurant discovery influences dining and entertainment choices.

📱 Travel and cultural content showcase seasonal events and local experiences.

📱 Behind-the-scenes brand content provides authentic business insights.

Shopping and E-Commerce Integration

Instagram Shopping functionality transforms content discovery into direct purchase opportunities, enabling users to research and buy products without leaving the platform. This integration particularly benefits fashion, beauty, and lifestyle brands that rely on visual presentation for product appeal and cultural relevance demonstration.

Influencer Marketing Ecosystem

Japanese Instagram influencers maintain stronger domestic influence than international celebrities, reflecting cultural preferences for relatability and authentic experience sharing. Micro-influencers often achieve higher engagement rates than macro-influencers, suggesting that niche expertise and community connection outperform broad reach metrics.

Strategic Implications for 2025

Reels and short-form video content demonstrate explosive growth as Instagram competes with TikTok for Gen Z attention. Seasonal content optimization around cultural events like cherry blossom season and traditional festivals significantly improves engagement and brand association opportunities.

Key Takeaways for Brands:

💡 Visual quality standards require professional photography and culturally appropriate aesthetic choices.

💡 Seasonal content integration leverages cultural moments for increased engagement.

💡 Shopping integration provides direct conversion opportunities from content discovery.

💡 Micro-influencer partnerships often deliver superior ROI compared to celebrity collaborations.

Professional Recommendations:

Invest in high-quality visual content that incorporates seasonal themes and cultural elements relevant to Japanese audiences. Utilize Instagram Shopping features to create seamless purchase experiences while partnering with micro-influencers who demonstrate authentic product usage within culturally relevant contexts.

TikTok demonstrates remarkable growth with 26.9 million users aged 18+ and 70% penetration among users aged 13-19, representing a 15% year-over-year increase. The platform’s average user age has risen to 34, significantly older than global averages, indicating successful expansion beyond initial Gen Z adoption patterns.

Content Innovation and Cultural Adaptation

TikTok actively localizes content to suit Japanese cultural preferences, featuring region-specific trends, challenges, and music that create cultural relevance and community belonging. The platform’s algorithm enables content discovery without requiring large follower bases, providing opportunities for brands and creators to achieve viral reach through quality content rather than established audience size.

E-Commerce Integration and Shopping Features

TikTok Shop launched in Japan in June 2025, representing significant expansion of social commerce capabilities within the platform. This integration enables direct product discovery, demonstration, and purchase within the entertainment consumption experience, potentially disrupting traditional e-commerce and advertising models.

Marketing Performance and Brand Opportunities

TikTok’s CPM rates remain lower than Meta platforms while delivering high engagement rates, particularly for authentic, user-generated content styles. Brands that embrace TikTok’s informal, creative content approach often achieve better results than those attempting to adapt traditional advertising formats.

Strategic Implications for 2025

Authenticity significantly outperforms polished corporate content on TikTok, requiring brands to develop more relaxed, behind-the-scenes communication styles that feel native to the platform’s creative community culture rather than intrusive advertising interruptions.

Key Takeaways for Brands:

💡 Creative, authentic content outperforms traditional advertising in engagement and conversion metrics.

💡 Algorithm-driven discovery enables viral reach without large initial audiences.

💡 E-commerce integration will create new direct-sales opportunities within entertainment contexts.

💡 Lower CPM costs provide budget efficiency advantages for experimental campaigns.

Professional Recommendations:

Develop creative, authentic content strategies that embrace TikTok’s informal communication style while partnering with creators who understand platform culture. Prepare for TikTok Shop integration by developing shoppable content that naturally incorporates product demonstrations within entertaining, educational contexts.

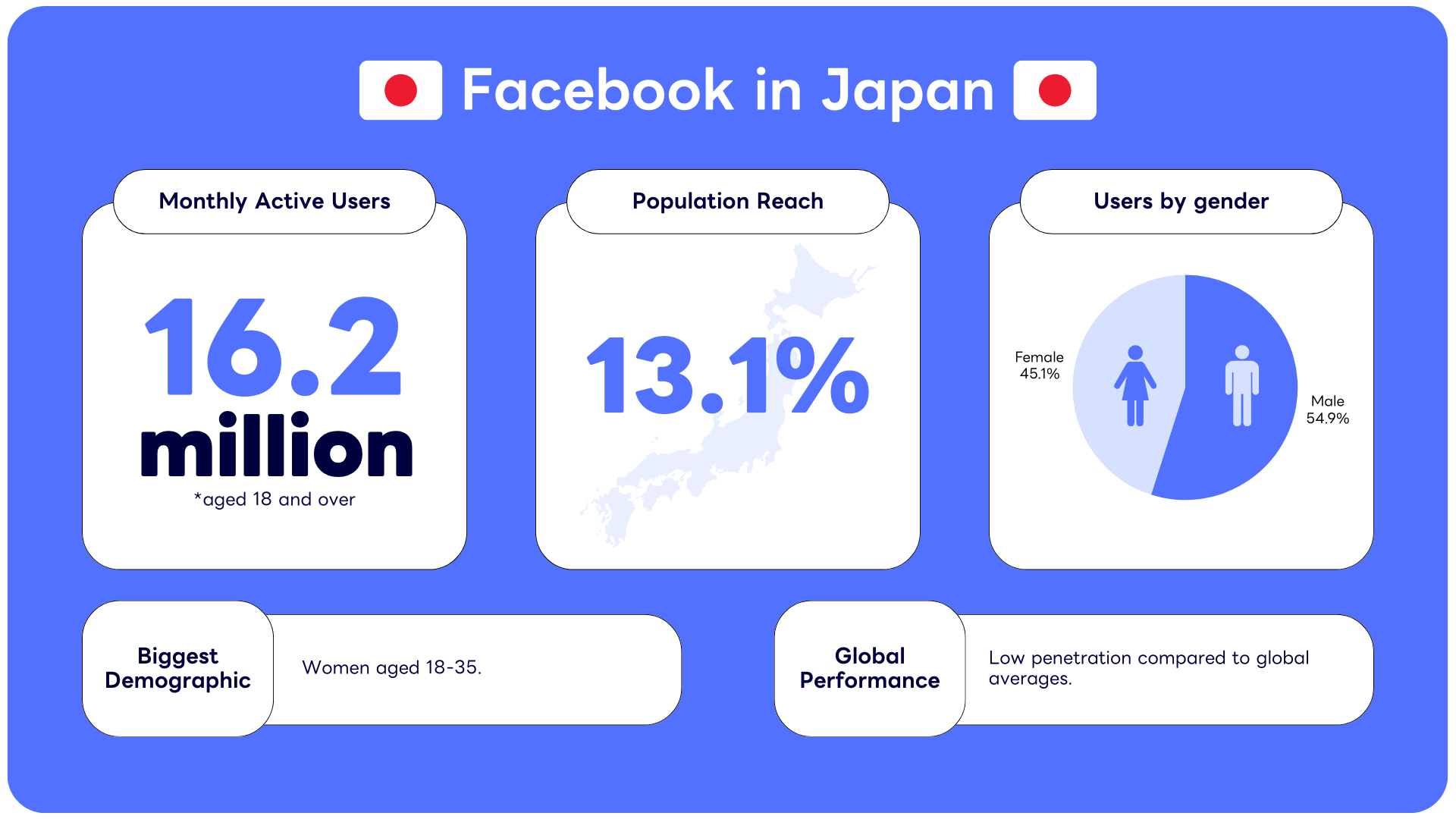

Facebook maintains a modest user base of 16.2 million compared to global penetration rates, functioning similarly to LinkedIn in other markets as a professional networking and business communication platform. The user base consists primarily of working professionals aged 35+ with higher disposable incomes and business networking needs.

Cultural Barriers and Adoption Challenges

Real-name requirements and open sharing models conflict with Japanese privacy preferences, limiting platform adoption among users who prefer anonymous or controlled-visibility interaction options. Early interface localization challenges and competition from established platforms like LINE prevented Facebook from achieving critical mass during crucial market development periods.

Business and B2B Opportunities

Combined advertising reach with Instagram provides sophisticated targeting capabilities for brands seeking to reach specific demographic and professional segments. The platform’s detailed user data and advanced advertising tools enable precise audience selection and campaign optimization, particularly valuable for B2B and professional services marketing.

Strategic Implications for 2025

Professional and expatriate communities utilize Facebook for business networking and community building, creating niche opportunities for brands serving these specific demographic segments. Social proof and credibility building remain strong platform advantages due to real-name requirements and professional associations.

Key Takeaways for Brands:

💡 Professional demographic focus suits B2B and premium product marketing.

💡 Advanced targeting capabilities enable precise audience selection and campaign optimization.

💡 Social proof advantages support credibility building for professional services and luxury products.

💡 Limited youth reach requires multi-platform strategies for comprehensive demographic coverage.

Professional Recommendations:

Utilize Facebook’s advanced targeting capabilities for B2B campaigns and professional services marketing while leveraging the platform’s social proof advantages for credibility building. Focus on authentic, long-form content that provides industry insights and thought leadership rather than broad consumer marketing approaches.

Japanese social media users demonstrate consistent preference for controlled visibility and selective sharing across all major platforms. Survey data indicates 45% of users prefer anonymous interaction capabilities, driving success for platforms like X (Twitter) that enable pseudonymous engagement while maintaining meaningful community participation.

Private messaging significantly outperforms public posting in terms of daily engagement volume and user satisfaction metrics. LINE’s dominance reflects this preference, with users treating the platform as a private communication utility rather than a public broadcasting tool. This trend influences content strategy, suggesting that brands achieve better results through direct, personalized communication rather than viral public campaigns.

Avatar usage and nickname preferences reflect cultural norms around personal privacy and professional reputation management. Instagram profiles frequently feature pets, anime characters, or artistic imagery instead of personal photographs, requiring brands to develop engagement strategies that respect anonymity preferences while building authentic connections.

Japanese users exhibit sophisticated platform-specific usage patterns that optimize each platform’s unique strengths rather than replicating content across channels. YouTube serves as primary video consumption platform, X provides news and real-time discussion, Instagram enables visual discovery, and LINE handles private communication and utility functions.

Cross-platform content discovery follows predictable patterns: users typically discover trends on TikTok or Instagram, research details on YouTube, discuss implications on X, and share relevant information through LINE. Understanding these discovery paths enables brands to develop coordinated campaigns that guide users through complete engagement journeys rather than competing for attention within single platforms.

Download our free Japanese Marketing Calendar here →

Seasonal content consumption peaks align with cultural events and traditional calendar rhythms. Cherry blossom season, summer festivals, year-end celebrations, and New Year periods generate significantly higher engagement rates, suggesting that successful campaigns synchronize with cultural timing rather than global product launch schedules or fiscal year considerations.

⭐️ Threads and Micro-Blogging Alternatives

Threads maintains approximately 7 million users (5% of global user base) but has not achieved critical mass necessary for long-term success in Japan’s competitive social media environment. The platform’s inability to differentiate significantly from X’s established functionality limits growth potential in a market that values unique utility and cultural integration.

⭐️ LinkedIn’s Professional Networking Niche

LinkedIn reaches 4.9 million users (4.6% of total population) but remains significantly underutilized compared to Western markets. Cultural preferences for traditional face-to-face relationship building and reluctance to publicly showcase career achievements limit professional social media adoption among Japanese professionals.

⭐️ Creative and Artistic Platforms

Pixiv serves Japan’s creative community with over 50 million registered users globally, providing specialized platform for illustrators, artists, and creative professionals. The platform’s focus on Japanese manga, anime, and digital art culture creates opportunities for brands targeting creative industries and artistic communities.

⭐️ Pinterest’s Creative Inspiration Role

Pinterest maintains 9.22 million users (6.6% of population) with 62.2% female demographic composition, serving designers, artists, and individuals seeking creative inspiration. The platform’s visual discovery capabilities complement other social media platforms for lifestyle and creative content distribution.

⭐️ Live Streaming and Virtual Reality Platforms

Reality combines VTuber culture with social streaming, allowing users to interact with virtual personalities and participate in live events. This platform reflects Japan’s leadership in virtual entertainment and provides unique opportunities for brands exploring virtual influencer marketing and interactive experiences.

⭐️ BeReal’s Authenticity Focus

BeReal gains traction among younger Japanese users who value authentic, unfiltered content sharing. The platform’s spontaneous snapshot approach resonates with Gen Z preferences for genuine social media experiences, creating opportunities for brands seeking to connect with authenticity-focused demographics.

⭐️ Niche Community Engagement

Smaller platforms often provide higher engagement rates and more dedicated communities compared to mainstream alternatives. Brands targeting specific interests, demographics, or cultural segments may achieve better results through focused niche platform strategies rather than broad mainstream approaches.

⭐️ Cultural Integration Requirements

Alternative platforms succeeding in Japan demonstrate sophisticated cultural adaptation and localization beyond simple language translation. Platforms that integrate Japanese cultural elements, seasonal events, and communication styles achieve higher adoption rates and user loyalty.

⭐️ Community Building Opportunities

Niche platforms enable brands to build dedicated communities around specific interests, products, or services without competing against large-scale mainstream content. These environments often foster deeper brand relationships and higher customer lifetime value compared to broad-reach strategies.

❗️ Rise of Niche Digital Creators and Micro-Communities

Digital creators focusing on specific niches and interests achieve higher engagement rates and stronger community connections compared to broad-appeal content strategies. Authentic, relatable experiences and specialized expertise generate higher trust levels than traditional media figures or large-scale influencer profiles.

❗️ “Oshi” Culture and Fandom Engagement

Gen Z users increasingly organize around specific interests, hobbies, or personalities (referred to as “oshi” culture), creating tight-knit communities with high engagement and loyalty. Brands successfully targeting these communities achieve significant influence within passionate, dedicated audience segments that demonstrate strong purchase intent and brand advocacy.

❗️ Micro-Influencer Effectiveness

Individuals with modest followings often achieve superior engagement rates compared to macro-influencers, suggesting that authentic connection and specialized expertise outperform broad reach metrics. This trend creates opportunities for brands to work with multiple niche creators rather than relying on single high-profile partnerships.

Download our free white paper about social media in Japan here →

❗️ Traditional Media Trust Decline

Strong organizational trust issues drive users toward social media for immediate news and information about current events, politics, and cultural developments. Platforms like X and YouTube serve as primary information sources, particularly for younger demographics who prioritize real-time updates over traditional broadcasting schedules.

❗️ Information Verification Challenges

The shift toward social media news consumption creates challenges around misinformation navigation and conflicting viewpoints, particularly regarding volatile political topics and international conflicts. Users develop sophisticated strategies for cross-referencing sources and evaluating content credibility.

❗️ Brand Content as Information Source

Brands providing helpful, informative content achieve higher trust and engagement compared to promotional messaging. Educational content, industry insights, and helpful tips generate stronger brand associations and customer relationships than traditional advertising approaches.

❗️ Political and Social Commentary

Social media serves as substitute for public protests and gatherings in a culture that values anonymity and individual expression. Platforms enabling anonymous or pseudonymous participation provide outlets for government criticism and social issue discussion that might be difficult in face-to-face contexts.

❗️ Cultural Change and Social Movements

Digital platforms facilitate cultural conversations and social movement organization while respecting traditional preferences for harmony and consensus building. Anonymous participation enables broader demographic involvement in social change discussions without personal or professional risk.

🤝 Real-Time Customer Communication

Brands increasingly leverage messaging platforms for customer service due to accessibility, immediacy, and convenience advantages over traditional phone and email support. LINE’s chatbot capabilities and Instagram direct messaging enable 24/7 customer support that meets Japanese quality and response time expectations.

🤝 Automated and AI-Enhanced Support

AI-driven chatbot technology enables immediate response capabilities while maintaining human oversight for complex customer issues. This hybrid approach provides efficiency advantages while preserving the high-quality customer service standards that Japanese consumers expect from business interactions.

📍 Cultural Research and Content Adaptation

Businesses demonstrate increasing willingness to invest in comprehensive localization beyond simple translation, incorporating cultural research, seasonal timing, and aesthetic preferences into social media strategies. This investment in cultural understanding generates significant engagement and brand affinity improvements.

📍 Seasonal and Event-Based Marketing

Cultural calendar integration and seasonal content optimization significantly improve campaign performance compared to global standard approaches. Cherry blossom season, traditional festivals, and cultural events provide opportunities for authentic brand integration within Japanese cultural contexts.

👩🏻💻 Trust and Credibility Building

Influencers maintain high trust levels and authority in information dissemination across news, trends, and product recommendations. This influence extends beyond entertainment to include serious topics like health information, political commentary, and social issue awareness.

👩🏻💻 Cultural Norm Influence

Social media personalities significantly impact cultural trends and social behaviors, often serving as early adopters and trend setters for broader population segments. Their influence extends beyond product recommendations to lifestyle choices, social values, and cultural preferences.

👵🏻 Older Demographic Social Media Adoption

Japan’s aging population with high disposable incomes creates opportunities for brands targeting mature demographics across platforms like X and Facebook. These users demonstrate sophisticated platform usage and purchasing power that justify premium product and service marketing investments.

👵🏻 Multi-Generational Marketing Approaches

Successful campaigns develop platform-specific strategies that respect age-based preferences while maintaining consistent brand messaging across different demographic segments. This approach requires sophisticated understanding of generational communication styles and platform usage patterns.

Japan’s social media landscape in 2025 represents a sophisticated ecosystem where cultural values, technological innovation, and consumer behavior create unique opportunities for brands that invest in comprehensive understanding and authentic engagement strategies. The market’s 109 million active social media users across multiple platforms generate significant revenue potential for companies that move beyond translation to embrace cultural integration and platform-specific optimization.

LINE’s continued dominance with 98 million users demonstrates the importance of utility-integrated social platforms that serve daily life needs rather than merely providing entertainment or communication options. International brands must recognize that successful Japanese social media strategies require treating these platforms as essential business infrastructure rather than optional marketing channels.

For detailed insights on LINE’s market dominance, refer to our comprehensive analysis: Why LINE is the Most Popular Social Media App in Japan

Looking ahead, social commerce integration, AI-enhanced customer service, and continued platform localization will define competitive advantages in Japan’s evolving social media landscape. Success requires ongoing investment in cultural understanding, technological adaptation, and authentic community building that respects Japanese values while embracing digital innovation opportunities.

We are official media reps for LINE. This means that we are able to provide our clients with comprehensive support services completely free of charge.

⭐️ A dedicated specialist provides strategic guidance and operational support, free of charge.

⭐️ Comprehensive support from account creation, to set up and activation.

⭐️ No contracts or minimum needed.

⭐️ The latest information such as market trends and industry insights to help your planning.