Insights >

Japanese Gaming – Powerful Insights into the Industry

New: 2026 Japanese Marketing Calendar | download for FREE >>

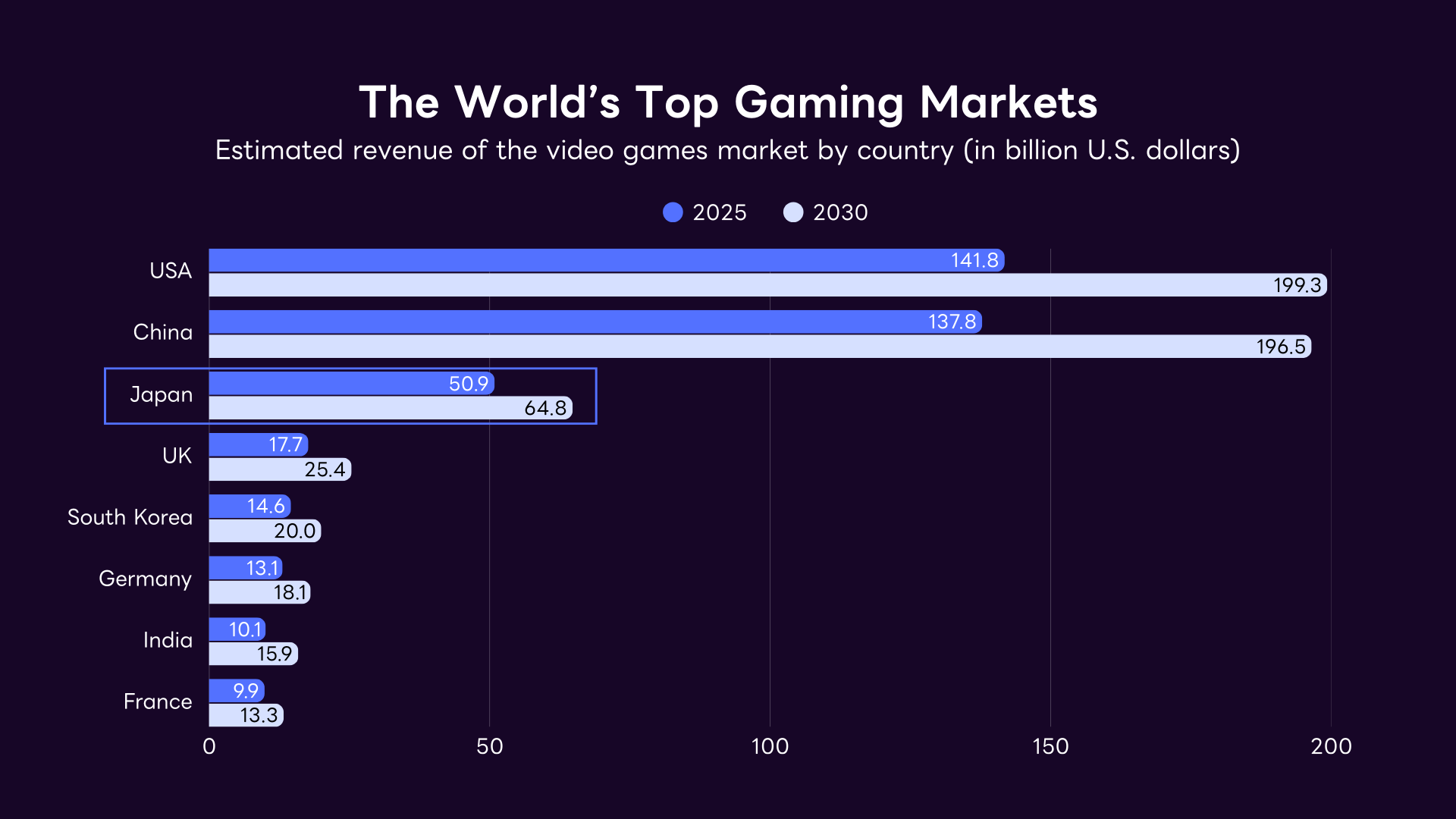

Japan is the world’s third-largest gaming market, generating $50.94 billion in revenue in 2025 – a staggering figure for a country with just 2.2% of the global player base. What makes this even more remarkable is the mobile gaming segment alone, which hit $11 billion in in-app purchase (IAP) revenue in 2025, ranking second only to China globally.

For game publishers seeking to expand internationally, Japan is one of the most lucrative and competitive markets. Yet success here requires a fundamentally different approach than Western markets, and understanding why Yahoo! JAPAN and LINE dominate the advertising landscape is critical to your strategy.

Table of Contents

The Japanese gaming market’s strength lies in its exceptional monetization per player. According to industry data, each Japanese gamer spends approximately $580-807 annually on games and in-app purchases—far exceeding global averages. In 2024, Japan’s total gaming market reached $26.3 billion, with mobile accounting for 69% of this revenue. Mobile gaming is projected to reach approximately $21 billion by 2026, growing at a compound annual rate of 10%+ through 2033.

What drives this exceptional spending? Japanese players have distinct preferences shaped by decades of gaming culture: they favor deep RPGs with narrative-driven content, gacha mechanics, character-collection systems, and seasonal event-driven monetization. Games like Monster Strike (which has generated $11+ billion in lifetime revenue) and Uma Musume Pretty Derby dominate revenue charts, demonstrating the power of IP attachment and polished execution in this market.

The gaming population itself is substantial and growing. Japan now has approximately 55.5 million video game players, projected to reach 66 million by 2029. This represents nearly 50% of Japan’s population, and it continues to expand, particularly among mobile players.

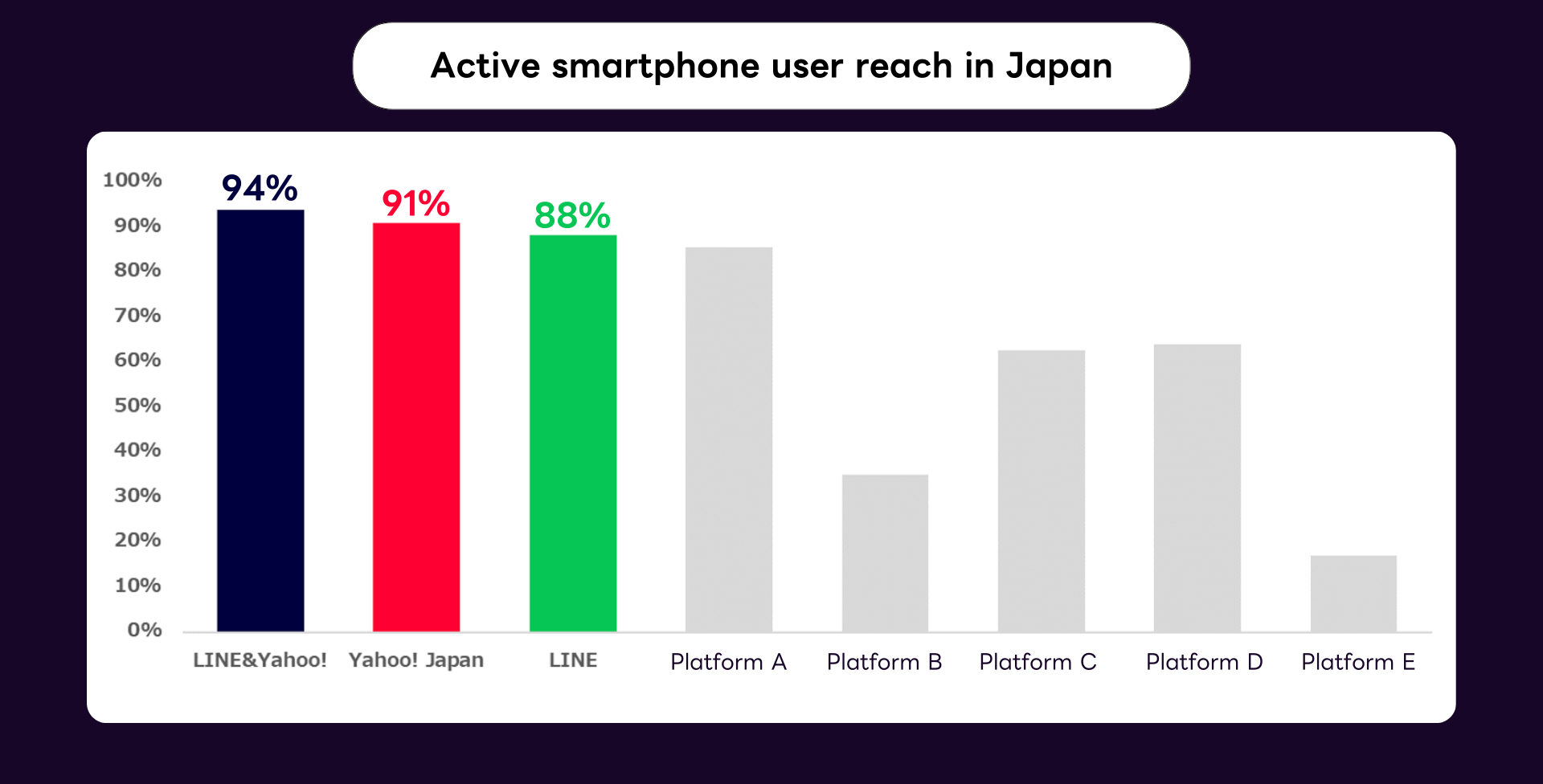

While global advertising platforms like Google Ads and Meta remain viable, Yahoo! JAPAN and LINE offer a uniquely powerful combination of reach, cultural alignment, and operational efficiency unmatched by any other platform for gaming publishers in Japan.

Yahoo! JAPAN reaches approximately 80% of smartphone users in Japan, with 54 million logged-in monthly users. It functions as Japan’s primary internet portal, serving as the go-to destination for news, search, shopping, finance, and information discovery. Japanese consumers trust Yahoo! JAPAN implicitly, making it an ideal platform for user acquisition campaigns where credibility and context matter.

LINE boasts 99 million monthly active users and is far more than a messaging app. It’s a super-app embedded into daily Japanese life, offering everything from shopping and payments to news, entertainment, and mini-apps. Together, Yahoo! JAPAN and LINE reach 94% of active smartphone users in Japan – a penetration rate no other platform combination can match.

The strategic advantage of using both platforms lies in their complementary roles:

Yahoo! JAPAN Search Ads capture high-intent users actively searching for game titles, genres, and related keywords. When a Japanese player searches for “スマホRPG” (mobile RPG) or “ガチャゲーム” (gacha game), Yahoo! JAPAN Search is where they look. These campaigns typically deliver lower cost-per-install (CPI) and higher lifetime value (LTV) users compared to other channels.

Yahoo! JAPAN Display and LINE Ads excel at awareness and engagement. LINE placements, including its high-impact chat-list positions and LINE NEWS integrations, provide visibility during passive engagement moments when users are scrolling and discovering content. For game publishers, this translates to multiple touchpoints throughout the user’s day: morning news consumption on Yahoo! JAPAN, midday messaging and chat on LINE, evening video content on LINE VOOM.

Download our free Yahoo! JAPAN Ads Media Guide here →

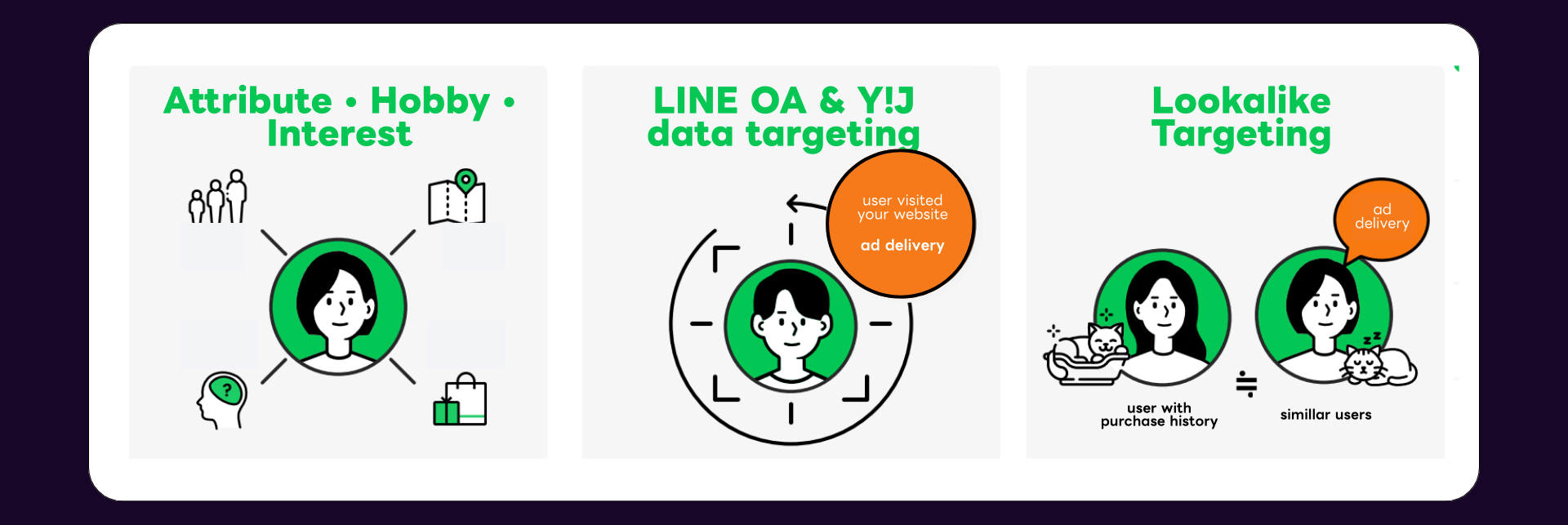

Publishers can now build audiences based on search behavior, news interests, shopping activity, and mobile app engagement, then deploy consistent messaging across both platforms. This integrated approach reduces wasted spend and improves overall campaign efficiency.

LINE’s targeting capabilities are particularly robust, offering demographic targeting (age, gender, location), behavioral targeting (gaming habits, purchasing behavior), and interest-based segmentation. Publishers can target users interested in anime, manga, specific game genres, esports, and entertainment properties—all critical for reaching game-enthusiast audiences.

One of the most practical advantages: publishers can now manage LINE ad delivery directly through Yahoo! JAPAN Ads accounts. This consolidation simplifies campaign setup, budget management, and reporting—a significant operational advantage for teams managing multiple markets.

Understanding acquisition costs is essential for budgeting and ROI planning. Mobile game CPI in Japan varies significantly by genre:

RPGs and Hardcore Games: iOS ~$6.00, Android ~$4.50

Strategy Games: iOS ~$5.50, Android ~$4.00

Mid-Core Games: iOS ~$4.50, Android ~$3.25

Puzzle Games: iOS ~$3.00, Android ~$2.00

Hyper-Casual Games: iOS ~$2.50, Android ~$1.50

Japan’s CPI is notably higher than global averages due to the market’s wealth and high ARPU. However, this translates to better quality users with substantially higher LTV. A successful campaign on Yahoo! JAPAN Search can achieve CPIs at the lower end of these ranges due to intent-driven targeting and algorithm optimization.

For market entry, publishers should budget ¥3-5 million (approximately USD $20,000-35,000) monthly for 3-6 months to generate sufficient install volume and LTV data for optimization.

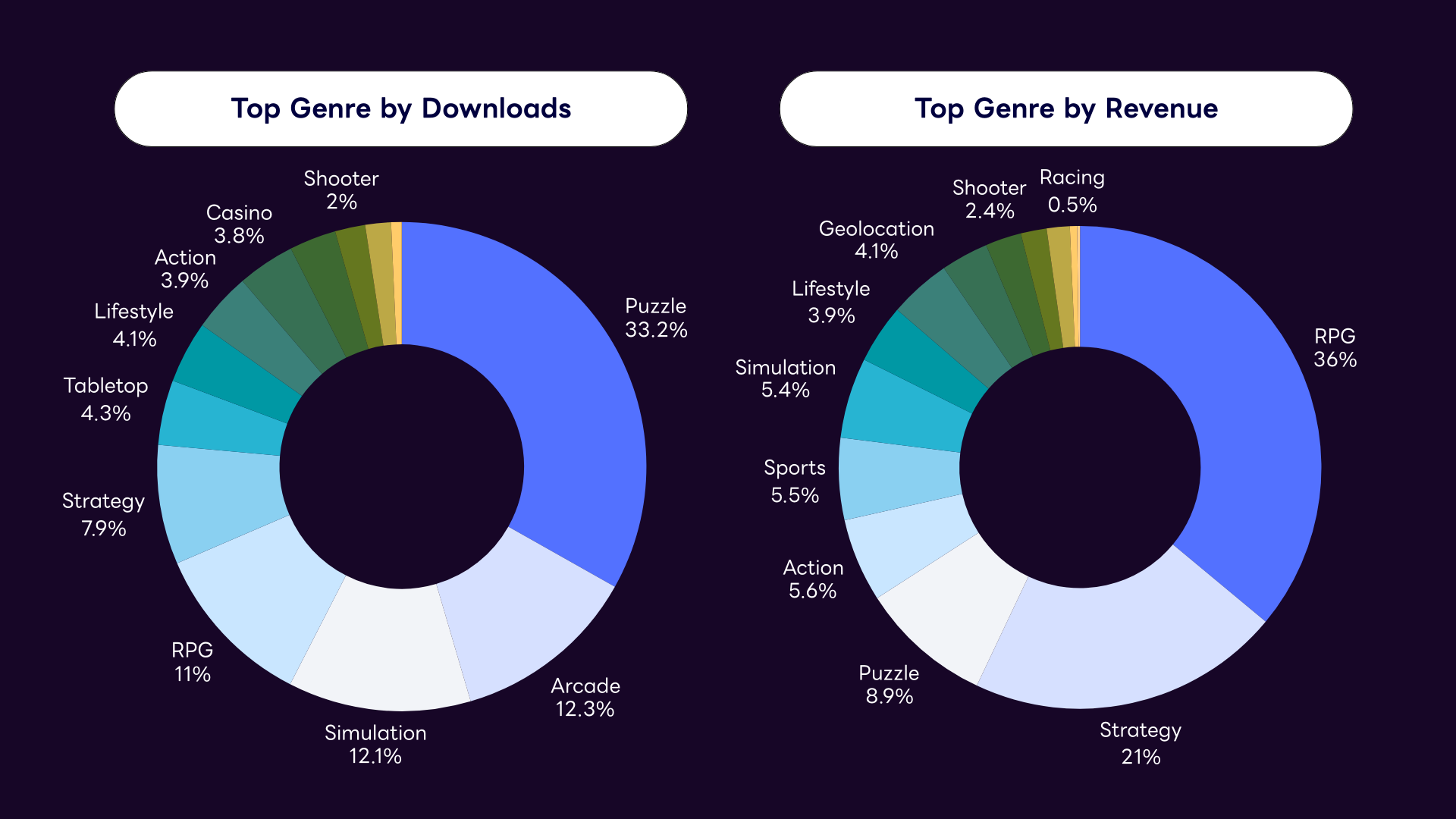

Not all game genres perform equally on Yahoo! JAPAN and LINE. RPGs dominate revenue, accounting for more than one-third of Japan’s mobile gaming revenue, supported by strong affinity for anime-style creatives and character-forward messaging. Strategy games perform strongly as well, followed by simulation games, which resonate with Japanese players’ preference for progression systems.

Creative approach matters significantly. Game ads showcasing character stats and rarity levels, gameplay loop demonstrations, limited-time event messaging, and cinematic storytelling consistently outperform generic ads. Localization extends beyond translation to cultural adaptation—Japanese players respond to manga/anime aesthetics, event-driven narratives, and clear gacha mechanics more effectively than Western-style gaming creatives.

📍Localize Comprehensively – Full game translation, UI adaptation, and cultural contextualization by native Japanese specialists.

💸 Allocate Budget Strategically – Structure as: Yahoo! JAPAN Search (40%), Yahoo! JAPAN Display (30%), LINE Ads (30%). This balances intent-driven conversion with brand awareness.

🎮 Align with In-Game Events – Synchronize paid campaigns with major in-game events, seasonal moments (Golden Week, New Year, Obon), and IP collaborations for maximum organic lift.

📅 Measure Beyond Day 1 – Track Day 7, Day 30, and Day 90 retention and LTV. Most profitable campaigns take 60-90 days to mature.

📱Test Creatives Aggressively – Allocate 20-30% of budget to creative testing in Month 1; scale winners while maintaining 10-15% testing budget ongoing.

Download our free Japanese Mobile App Industry Trend Report here →

For game publishers targeting Japan in 2025, the strategic choice is clear: Yahoo! JAPAN and LINE together represent the optimal entry point into this high-value market.

Their combined reach, integrated audience data, full-funnel capabilities, and proven track record with top-grossing Japanese games make them indispensable. The market demands quality localization, cultural understanding, and disciplined marketing execution – but for publishers willing to commit, Japan’s $50+ billion gaming market awaits.

We are official overseas media reps for LINE Yahoo! advertising products. We provide clients with 100% free support, a dedicated account manager, and the latest market insights.

Click here to contact our team and discuss how we can support your brand in advertising in Japan.